ALBemarle Corporation (NYSE: ALB), a leader in the global specialty chemicals industry, today announced that it will realign its Bromine and Lithium global business units (GBU) into a new corporate structure designed to better meet customer needs and foster talent required to deliver in a competitive global environment. The move follows the recent announcement of the company's decision to reorganize Catalyst under a to-be-named, wholly owned subsidiary.

Albemarle's two core global business units will become:

Albemarle CEO Kent Masters stated, "These changes reflect Albemarle's focus on growing our business, our people, and our value by being agile in providing innovative solutions that anticipate customer needs and meet the markets of tomorrow."

Organizational changes for Albemarle Specialties and Albemarle Energy Storage are expected to be effective January 1, 2023 . Beginning in 2023, the company will financially report through the following segments: energy storage, specialties, and catalysts.

About Albemarle

ALBemarle Corporation (NYSE: ALB) is a global specialty chemicals company with leading positions in lithium, bromine, and refining catalysts. We think beyond business as usual to power the potential of companies in many of the world's largest and most critical industries, such as energy, electronics, and transportation. We actively pursue a sustainable approach to managing our diverse global footprint of world-class resources. In conjunction with our highly experienced and talented global teams, our deep-seated values, and our collaborative customer relationships, we create value-added and performance-based solutions that enable a safer and more sustainable future.

We regularly post information to www.albemarle.com , including notification of events, news, financial performance, investor presentations and webcasts, non-GAAP reconciliations, SEC filings and other information regarding our company, our businesses, and the markets we serve.

Forward-Looking Statements

Some of the information presented in this press release, including, without limitation, information related to the timing and transition to, and the benefits of, the Company's new portfolio model, the expected focus of the company's global business units, anticipated return on opportunities, and including all information relating to matters that are not historical facts may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from the views expressed. Factors that could cause Albemarle's actual results to differ materially from the outlook expressed or implied in any forward-looking statement include, without limitation: changes in economic and business conditions; changes in financial and operating performance of its major customers and industries and markets served by it; the timing of orders received from customers; the gain or loss of significant customers; fluctuations in lithium market pricing, which could impact our revenues and profitability particularly due to our increased exposure to index-referenced and variable-priced contracts for battery grade lithium sales; changes with respect to contract renegotiations; potential production volume shortfalls; competition from other manufacturers; changes in the demand for its products or the end-user markets in which its products are sold; limitations or prohibitions on the manufacture and sale of its products; availability of raw materials; increases in the cost of raw materials and energy, and its ability to pass through such increases to its customers; technological change and development, changes in its markets in general; fluctuations in foreign currencies; changes in laws and government regulation impacting its operations or its products; the occurrence of regulatory actions, proceedings, claims or litigation (including with respect to the U.S. Foreign Corrupt Practices Act and foreign anti-corruption laws); the occurrence of cyber-security breaches, terrorist attacks, industrial accidents or natural disasters; the effect of climate change, including any regulatory changes to which it might be subject; hazards associated with chemicals manufacturing; the inability to maintain current levels of insurance, including product or premises liability insurance, or the denial of such coverage; political unrest affecting the global economy, including adverse effects from terrorism or hostilities; political instability affecting our manufacturing operations or joint ventures; changes in accounting standards; the inability to achieve results from its global manufacturing cost reduction initiatives as well as its ongoing continuous improvement and rationalization programs; changes in the jurisdictional mix of its earnings and changes in tax laws and rates or interpretation; changes in monetary policies, inflation or interest rates that may impact its ability to raise capital or increase its cost of funds, impact the performance of its pension fund investments and increase its pension expense and funding obligations; volatility and uncertainties in the debt and equity markets; technology or intellectual property infringement, including cyber-security breaches, and other innovation risks; decisions it may make in the future; future acquisition and divestiture transactions, including the ability to successfully execute, operate and integrate acquisitions and divestitures and incurring additional indebtedness; continuing uncertainties as to the duration and impact of the coronavirus (COVID-19) pandemic; performance of Albemarle's partners in joint ventures and other projects; changes in credit ratings; and the other factors detailed from time to time in the reports Albemarle files with the SEC, including those described under "Risk Factors" in Albemarle's most recent Annual Report on Form 10-K any subsequently filed Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this press release. Albemarle assumes no obligation to provide any revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws. ![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/albemarle-announces-new-global-business-unit-alignment-301613585.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/albemarle-announces-new-global-business-unit-alignment-301613585.html

SOURCE Albemarle Corporation

News Provided by PR Newswire via QuoteMedia

Benton Resources Inc. (TSXV: BEX) ("Benton" or "the Company") today announces results from the Phase II drilling program at its Far Lake Copper-Silver project located 80 km west of Thunder Bay, Ontario. The second phase of drilling at Far Lake totaled 2,696 m and was designed to test new areas associated with surface mineralization as well as various chargeability anomalies outlined by a deep, 3D IP geophysical survey. Highlights from this latest campaign include copper mineralization in the previously untested Centre Pond zone, intersected at a drill hole depth of 338 m (DDH FL-21-17).

Benton continues to be encouraged by the Cu mineralization identified in this intrusive complex and will continue to model the data collected for further targeting on the project. The Company is presently collecting up to 3,500 soil samples for multi-element analysis and is actively mapping and prospecting the property to generate further targets for drilling later this year. Geochemical anomalies identified in 2020 soil sampling led to the discovery at FL-20-11.

Additional sampling of DDH FL-20-11 (drilled in the first campaign) increased the width of a previously released mineralized interval by 4 m, expanding the mineralized zone to 0.15% Cu over 64.2 m including 0.35% Cu over 15.6 m and 1.08% Cu and 1.63 g/t Ag over 2.6 m.

Drill hole FL-20-11 is located approximately 1,800 m NW along the same structure as the Far Lake Discovery Zone where surface sampling produced Cu grades up to 22% over 0.7 m and first phase drill results yielded intercepts of 0.19% Cu and 0.34 g/t Ag over 33.6 m including 1.11% Cu and 1.33 g/t Ag over 3.1 m (FL-20-03). The Discovery Zone continues to be interrupted by mafic dykes and the Company continues to model the dykes to better understand the structure controlling mineralization and to avoid hitting them in future drilling within the mineralized zones.

Drill holes FL-21-13 & 14 were drilled in the vicinity of hole FL-20-11 (0.15% Cu over 64.2 m) and were successful at intersecting the granodiorite with advanced argillic alteration that hosts up to 5% chalcopyrite locally. Additionally, the granodiorite includes moderate phyllic (chl-ser), propylitic (qtz-epi-carb) and weak potassic (kspar-alb-qtz) alteration. Highlights from these holes include 0.25% Cu over 3 m and 0.12% Cu over 3 m, in holes 13 and 14 respectively.

FL-21-15 was nearly a 200 m eastern step-out from FL-20-11 and again intersected a chalcopyrite mineralized altered granodiorite containing up to 0.1% Cu over 14 m.

FL-21-16 was the deepest hole of the campaign and targeted a deep IP chargeability anomaly coinciding with mineralized surface samples. Anomalous copper mineralization was encountered throughout the hole, but more importantly intersected a major lithological contact between granitic and metasedimentary rocks at depth, which will be important when mapping the units on the property.

FL-21-17 was drilled 425 m below the Centre Pond zone and intersected mainly red granite with strong potassic, hematite alteration with magnetite. The coarse, red granite contains blebby chalcopyrite and pyrite. Highlights include 0.16% Cu over 6 m.

FL-21-18 targeted an airborne VLF anomaly along strike of the discovery zone. Copper mineralization was insignificant, but the hole intersected a wet structure that could account for the anomaly.

FL-21-19 was drilled below the discovery zone at depths deeper than the first phase of drilling. Sulphide mineralization is primarily seen as blebby or disseminated pyrite in zones of strong deformation as well as chalcopyrite in zones of strong deformation, as blebs in a silica-infilled breccias or as wisps in a quartz vein. Highlights include 0.13% Cu over 23 m.

FL-21-20 was a southern step-out from hole 19 and designed to intersect high-grade copper at depth. Unfortunately, this hole encountered another wide intrusive gabbro at an unexpected depth and angle and the mineralized zone was nearly missed altogether. Mineralized intervals include 0.12% Cu over 1.4 m and 0.11% Cu over 3 m.

In addition to copper mineralization, the campaign intersected weakly anomalous uranium in FL-21-16 (21ppm U over 10 m) and FL-21-19 (23.8ppm over 9 m).

Up-to-date copper results from Far Lake drilling are as follows:

*Previously released results

**No significant assays

A map showing the location of each hole is available on the Company's website (www.bentonresources.ca).

The Company would also like to announce that it has made the first anniversary payment pursuant to its option agreement with White Metal Resources Corp. ("White Metal") on the Far Lake property (see Company news release dated May 20, 2020). The Company paid White Metal $30,000 and issued 400,000 common shares of the Company.

Equity Holdings

Benton continues to be very encouraged by the progress made by Clean Air Metals Inc. ("Clean Air"), in which Benton holds 24.6 million shares. Clean Air has two drill rigs operating on the Thunder Bay North and Escape Lake Copper-Nickel-PGM projects and has released excellent drill results from its ongoing drill campaign. Benton looks forward to receiving ongoing encouraging drill results and future project advancement.

Benton also holds 3,940,000 shares of Quadro Resources Ltd, which is advancing various projects in Newfoundland and Ontario. Additionally, Benton holds 3.6 million shares of Maxtech Ventures Inc. Maxtech has an Option and Joint Venture agreement on Benton's Panama Lake gold project in the Red Lake mining region. Further, Benton holds 1.36 million shares of Metallica Metals advancing Benton's Saganaga (Starr) Gold project, and 1.0 million shares of Sokoman Minerals Corp. which continues to release excellent drill results from its Moosehead Project in Newfoundland. Benton recently entered into a strategic alliance with Sokoman Minerals for three large-scale joint venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Benton also has two NW Ontario projects optioned to Rio Tinto Exploration Canada (the Bark Lake and West Baril Lake Copper-Nickel PGE projects).

QP

Nathan Sims (P.Geo.), Senior Exploration Manager for Benton Resources Inc., the 'Qualified Person' under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

On behalf of the Board of Directors of Benton Resources Inc.,

"Stephen Stares"

Stephen Stares, President

About Benton Resources Inc.

Benton Resources is a well-funded Canadian-based project generator with a diversified property portfolio in Gold, Silver, Nickel, Copper, and Platinum group elements. Benton holds multiple high-grade projects available for option which can be viewed on the Company's website. Most projects have an up-to-date 43-101 Report available.

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-475-7474

Email:sstares@bentonresources.ca

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x251

Email:cathy@chfir.com

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/86499

News Provided by Newsfile via QuoteMedia

Cypress Development (TSXV:CYP, OTCQB:CYDVF) focuses on developing its 100 percent owned Clayton Valley lithium project in Nevada, USA. The company’s extensive exploration and development have led to discovering a world-class lithium-bearing claystone resource adjacent to the Albemarle (NYSE: ALB) Silver Peak mine, North America’s only lithium brine operation. The company’s discovery of the massive resource made Clayton Valley a premium American source of lithium that has the potential to impact the supply of lithium for the fast-growing energy storage battery market.

“We’re in Nevada and we’re in a country that badly needs lithium. We would be the most environmentally friendly project, and the lowest acid consumer. We’re able to eliminate sulfuric acid in our process and that would make us an extremely environmentally friendly, large, inexpensive low cost producer in the heart of the United States.” said Cypress Development CEO Dr. Bill Willoughby.

Sienna Resources Inc. (TSXV: SIE) (FSE: A1XCQ0) (OTC PINK: SNNAF) (the "Company") Sienna Resources is pleased to announce the commencement of field exploration at the Bleka Gold Project in Norway. The Bleka Vein was discovered in 1880 and mined intermittently until 1940, with historic production reported as 165 kilograms (i.e., ~ 5,300 troy ounces) of gold sourced from mineralized material with an average grade of 36 gt gold1. The historic Bleka vein is hosted in a deformed greenstone belt in southern Norway and was formed during two phases of quartz-veining events. Auriferous quartz veins characteristically contain Cu-Bi and tourmaline2. Compilation of historic reports combined with reconnaissance mapping revealed a series of under-explored vein swarms on the Bleka property. Earlier this year, a systematic sampling program to test the vein swarms was initiated to identify gold-rich vein sets. Results were encouraging with over 10% of samples showing anomalous gold results (6 of 52 rockchip samples contained more than 0.1 ppm Au)3. Historic reports show rock chip samples with similar quantities of anomalous results with some vein samples reaching up to 103 gt Au4. As a result of this field work, previously unknown quartz veins were discovered and follow-up soil sampling is currently being conducted in an attempt to identify additional buried quartz veins.

Going forward Sienna has planned more surface sampling coupled with a planned UVA supported magnetic survey which will delineating important structural features to generate high priority drill targets. Over the coming weeks the historic mine maps will be compiled to create 3D model of the known mineralization and drill planning will commence to test mineralized continuation down plunge and along strike from the existing mine workings. SIE has not performed sufficient work to verify the published data reported above, but SIE believes this information is considered reliable and relevant.

Bleka Property

To view an enhanced version of this map, please visit:

https://orders.newsfilecorp.com/files/854/67548_db8fca9c54acebad_002full.jpg

Jason Gigliotti, President of Sienna Resources stated, "We are pleased to continue on the initial success that has been achieved at the Bleka gold project. We have a methodical, tactical approach to generate the highest priority drill targets in the coming weeks and look forward to what the next phase of work on the property will uncover. Not only are we active on this exciting gold project, we are also active in Finland and Ontario on our platinum-palladium projects."

The technical contents of this release were approved by Greg Thomson, PGeo, a qualified person as defined by National Instrument 43-101.

About Sienna Resources

Sienna Resources Inc. is focused on exploring for and developing high-grade deposits in politically stable, environmentally responsible and ethical mining jurisdictions. Sienna is partnered with an NYSE listed mining company on three separate projects in Scandinavia including the past-producing Bleka & Vekselmyr Orogenic Gold Projects in Southern Norway which are both greenstone-hosted gold systems, the Kuusamo platinum group elements (PGE) project in Finland directly bordering the LK Project being advanced by Palladium One Mining Inc. (PDM-TSX.v), and the Platinum-Palladium-Nickel Slättberg Project in Southern Sweden. In North America, Sienna's projects include the Marathon North Platinum-Palladium Property in Northern Ontario directly bordering Generation Mining Ltd.'s (CSE: GENM) 7.1-million-ounce palladium-equivalent Marathon Deposit. Sienna also has the Clayton Valley Deep Basin Lithium Project in Clayton Valley, Nevada, home to the only lithium brine basin in production in North America, in the direct vicinity of Albemarle Corp's (NYSE: ALB) Silver Peak deposit and Tesla Motors Inc.'s (Nasdaq: TSLA) Gigafactory. Management cautions that past results or discoveries on properties in proximity to Sienna may not necessarily be indicative to the presence of mineralization on the Company's properties.

If you would like to be added to Sienna's email list please email info@siennaresources.com for information or join our twitter account at @SiennaResources.

Contact Information

Tel: 1.604.646.6900

Fax: 1.604.689.1733

www.siennaresources.com

info@siennaresources.com

"Jason Gigliotti"

President, Director

Sienna Resources Inc.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

1. Gamst & Thomsen (1998) Gold Exploration in The Seljord and Hjartdal area of Telemark, Southern Norway, Norwegian Geological Survey Report 4655. (https://dirmin.no/sites/default/files/bibliotek/BV4655.pdf)

2. Wilberg & Røsholt (1998) Exploration Report. Bleka Concession, Telemark South Norway, Norwegian Geologic Survey Report 4661. (https://dirmin.no/sites/default/files/bibliotek/BV4661.pdf)

3. Samples were collected in accordance with industry standards best practices. Samples are collected and sent to ALS Malå, Sweden prep lab before they are sent for analysis at ALS Ireland. Pulps are analyzed using four acid super trace analysis (ME-MS61) and cyanide leach with AAS finish (Au-AA14). Accredited control samples (blanks and standards) are inserted into the sample intervals regularly.

4. Harpøth & Gregersen (1984) Gold Exploration in the Belka Fold area, Telemark, Norwegian Geological Survey Report 1656. (https://dirmin.no/sites/default/files/bibliotek/BV1656.pdf)

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/67548

News Provided by Newsfile via QuoteMedia

Sienna Resources Inc. (TSXV: SIE) (FSE: A1XCQ0) (OTCBB: SNNAF) (the "Company") Sienna has closed its financing consisting of 2,222,222 flow-through shares for gross proceeds of $200,000. No warrants were issued in the financing. An aggregate finders' fee of $12,000 was paid in connection with the private placement. All the securities issued in connection with this private placement have a hold period that expires on February 17, 2021. Proceeds will be used towards the Company's planned work programs. The private placement is subject to final approval of the TSX Venture Exchange and was originally announced on October 14, 2020. Please refer to that news release.

This flow through will be allocated primarily for Sienna's Marathon North Platinum-Palladium Property in Northern Ontario directly bordering Generation Mining Ltd.'s (CSE: GENM) 7.1-million-ounce palladium-equivalent Marathon Deposit. Management cautions that past results or discoveries on properties in proximity to Sienna may not necessarily be indicative to the presence of mineralization on the Company's properties.

Jason Gigliotti states, "We are very pleased to have closed this placement, above the current market price and with no warrants attached, which will enable immediate work to begin on our Marathon North Platinum-Palladium Property in Ontario. Not only do we plan to be active on this exciting project we are also very active in Scandinavia on our platinum-palladium project in Finland and we expect to be drilling on our Norway gold project making the remainder of 2020 a very active period for Sienna. We are fully financed for all of our planned work programs in 2020 and look forward to what we uncover from having boots on the ground in at least 3 countries in the coming weeks."

The technical contents of this release were approved by Greg Thomson, PGeo, a qualified person as defined by National Instrument 43-101.

About Sienna Resources

Sienna Resources Inc. is focused on exploring for and developing high-grade deposits in politically stable, environmentally responsible and ethical mining jurisdictions. Sienna is partnered with an NYSE listed mining company on three separate projects in Scandinavia including the past-producing Bleka & Vekselmyr Orogenic Gold Projects in Southern Norway which are both greenstone-hosted gold systems, the Kuusamo platinum group elements (PGE) project in Finland directly bordering the LK Project being advanced by Palladium One Mining Inc. (PDM-TSX.v), and the Platinum-Palladium-Nickel Slättberg Project in Southern Sweden. In North America, Sienna's projects include the Marathon North Platinum-Palladium Property in Northern Ontario directly bordering Generation Mining Ltd.'s (CSE: GENM) 7.1-million-ounce palladium-equivalent Marathon Deposit. Sienna also has the Clayton Valley Deep Basin Lithium Project in Clayton Valley, Nevada, home to the only lithium brine basin in production in North America, in the direct vicinity of Albemarle Corp's (NYSE: ALB) Silver Peak deposit and Tesla Motors Inc.'s (Nasdaq: TSLA) Gigafactory. Management cautions that past results or discoveries on properties in proximity to Sienna may not necessarily be indicative to the presence of mineralization on the Company's properties.

None of the securities sold in connection with the private placement will be registered under the United States Securities Act of 1933, as amended, and no such securities may be offered or sold in the United States absent registration or an applicable exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

If you would like to be added to Sienna's email list please email info@siennaresources.com for information or join our twitter account at @SiennaResources.

Contact Information

Tel: 1.604.646.6900

Fax: 1.604.689.1733

www.siennaresources.com

info@siennaresources.com

"Jason Gigliotti"

President, Director

Sienna Resources Inc.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Not for distribution to U.S. Newswire Services or for dissemination in the United States.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/66387

News Provided by Newsfile via QuoteMedia

Highlights:

CB2 Insights (CSE:CBII, OTCQB:CBIIF) (“CB2” or the “Company”), a leading data-driven company focused on bringing real-world evidence driven from the point-of-care to the medical cannabis community, today announced it has partnered with Licensed Producer, Vireo Health International Inc. (“Vireo”) (CNSX:VREO, OTCQX:VREOF), to advance the proof of safety and efficacy for cannabinoid therapy as it relates to metered-dosing for patients with ailments in which cannabis-based medicine is believed to support. CB2 will oversee the protocol development and Investigational New Drug (IND) Application directly with the US Food & Drug Administration (FDA). The successful completion will position Vireo for industry leadership when it comes to cannabis-based topical medication used to treat pain. Vireo will also license the Company’s Sail technology platform for full data collection and management.

“Vireo is a cannabis company that understands the importance of full-scale research to prove out the true safety and efficacy of their products as they come to market,” said Prad Sekar, CEO, CB2 Insights. “As we have seen with the FDA over the past year, they are steadfast in ensuring that cannabis-based medicines follow the same protocols as other traditional pharmaceuticals. We are proud to have been chosen to advance that process with Vireo as we move forward with the IND application.”

Vireo is a physician-founded, science-focused vertically integrated cannabis company focused on bringing medical science and engineering effective cannabis-based medicine. Thousands of patients across seven U.S. states have used Vireo’s products for a wide range of conditions including chronic pain, cancer, epilepsy and many others as permitted under various state laws. Vireo’s line of cannabis-based topical products – currently available in Minnesota and scheduled to launch in other markets in 2020 – will be the focus of this project. CB2 Insights will manage the process of designing the protocol and working with the FDA on IND application approval.

“At Vireo, we are working to illustrate the positive impact that cannabis-based products can have for patients seeking to manage chronic or intractable pain through alternative treatment options,” said Kyle Kingsley, M.D. Chief Executive Officer, Vireo Health. “Our partnership with CB2 Insights will help us solidify the understanding and acceptance of cannabis-based medicine by following traditional healthcare protocols to achieve what many others in this space have been unable to do – produce clinical evidence of our products’ efficacy.”

CB2 Insights has active technology, data and research projects in North America, the UK and Colombia. As a cannabis-focused Contract Research Organization (CRO), the Company is able to support Licensed Producers, Multi-State Operators and other industry stakeholders from pre-clinical trial activities through to product commercialization by following traditional healthcare protocols regardless of the jurisdiction. CB2 also owns and operates the largest multi-state cannabis evaluation and education centers in the US, overseeing the care of more than 100,000 patients which expedites the development of patient registries and ultimately recruitment for clinical studies.

Both companies look to complete the initial stage of the project by Q1 2020.

About CB2 Insights

CB2 Insights (CSE:CBII) is a global leader in clinical operations, technology & analytics solutions and research and development services with a mission to mainstream medical cannabis into traditional healthcare. Providing immediate market access through its wholly-owned clinical network across 12 jurisdictions, proprietary data-driven technology solutions and comprehensive contract research services designed for those in both the medical cannabis and traditional life sciences industries, CB2 Insights is able to support its partners across the entire data and research spectrum.

CB2’s Clinical Operations business unit leverages extensive experience to develop clinical models with standard operating procedures, advanced workflows, training and ongoing management support. CB2 also owns and operates its own specialty clinics including the brands Canna Care Docs and Relaxed Clarity which assess nearly 100,000 patients seeking medical cannabis treatment to provide immediate market access to US-based product manufacturers for clinical trial and research programs.

The Company has built both electronic data capture (EDC) and clinical data management software (CDMS) which work to support its partners of any size to execute their data and clinical strategies.

CB2 also offers comprehensive contract research organization (CRO) services including full scale clinical trial management, trial design, monitoring and other key research functions used by licensed producers, multi-state operators and traditional pharmaceutical companies entering the medical cannabis space.

For more information please visit www.cb2insights.com.

About Vireo Health International, Inc.

Vireo Health International, Inc.’s mission is to build the cannabis company of the future by bringing the best of medicine, engineering and science to the cannabis industry. Vireo’s physician-led team of more than 400 employees provides best-in-class cannabis products and customer experience. Vireo cultivates cannabis in environmentally friendly greenhouses, manufactures pharmaceutical-grade cannabis extracts, and sells its products at both company-owned and third-party dispensaries. The Company currently is licensed in eleven markets including Arizona, Maryland, Massachusetts, Minnesota, New Mexico, New York, Nevada, Ohio, Pennsylvania, Puerto Rico, and Rhode Island. For more information about the company, please visit www.vireohealth.com.

Primary Contact:

For CB2 Insights

Dan Thompson – Chief Corporate Officer

1.855.874.4999 ext. 120

investors@cb2insights.com

For Vireo Health International Inc.

Albe Zakes – VP, Communications

albezakes@vireohealth.com

(267) 221-4800

Forward Looking Statements

Statements in this news release that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in CB2’s filings with Canadian securities regulators. When used in this news release, words such as “will, could, plan, estimate, expect, intend, may, potential, believe, should,” and similar expressions, are forward-looking statements.

Forward-looking statements may include, without limitation, statements regarding the opportunity to provide services and software to the U.S. cannabis industry.

Although CB2 has attempted to identify important factors that could cause actual results, performance or achievements to differ materially from those contained in the forward-looking statements, there can be other factors that cause results, performance or achievements not to be as anticipated, estimated or intended, including, but not limited to: dependence on obtaining regulatory approvals; investing in target companies or projects which have limited or no operating history and are subject to inconsistent legislation and regulation; change in laws; reliance on management; requirements for additional financing; competition; hindering market growth and state adoption due to inconsistent public opinion and perception of the medical-use and recreational-use marijuana industry and; regulatory or political change.

There can be no assurance that such information will prove to be accurate or that management’s expectations or estimates of future developments, circumstances or results will materialize. As a result of these risks and uncertainties, the results or events predicted in these forward-looking statements may differ materially from actual results or events.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release are made as of the date of this release. CB2 disclaims any intention or obligation to update or revise such information, except as required by applicable law, and CB2 does not assume any liability for disclosure relating to any other company mentioned herein.

Click here to connect with CB2 Insights (CSE:CBII) for an Investor Presentation.

Source

Delivering higher production capacity parameters at Pata Pila

Highlights:

“Theseresultsaregreatnewsfrombothan underlying geological, and resource confidence, point of view. We have demonstrated a high production capacity with the completion of the first long-term pumping test at Pata Pila, as well as extending the reservoir quality throughout the main alluvial deposits on our tenements with the latest exploration well intercepts. These outcomes provide further validation of the world-class nature of the HMW Project and its planned development.”

Well pump testing program delivering excellent results

Pata Pila

The 30-day long term pumping test at the first Pata Pila well (PPB-01-21) was successfully completed at the end of July. The sustained pumping rates were solid, ranging between 17 and 20 L/s. More than 150 brine samples were collected during this testing phase, with laboratory analysis returning an average Li grade of 874 mg/L (from a range of 821 to 927 mg /L).

The hydraulic testing of the second pumping well at Pata Pila (PPB-02-22) is set to commence shortly. This well is located approximately 800m upgradient in the Pata Pila alluvial fan (see Figure 1).

Click here for the full ASX Release

This article includes content from Galan Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Editor's note — This article was originally focused on the top Canadian lithium stocks, but has been expanded to cover the top lithium stocks globally. Click here to read about the top Canadian lithium stocks.

You can also click here to read the previous top lithium stocks article.

Lithium prices hit an all-time high in 2021 and continued that trend into 2022. Although prices have cooled slightly from their peak in March, they're still sitting near historic levels.

With lithium being a hot topic this year, there is much to be learned about where it could go moving forward. The Fastmarkets Lithium Supply and Raw Materials conference took place at the end of June, with panels on topics like geopolitics and global demand. Additionally, the Investing News Network spoke with experts in the space to find out what five things investors can expect from the sector through 2025.

Here the Investing News Network takes a look at the top lithium stocks with year-to-date gains. The list below was generated using TradingView’s stock screener on August 24, 2022, for Canadian and US companies, and August 25, 2022, for Australian companies. It includes companies listed on the NYSE, NASDAQ, TSX, TSXV and ASX; all top lithium stocks had market caps above $10 million when data was gathered.

Year-to-date gain: 135.63 percent; market capitalization: US$2.52 billion; current share price: US$25

In Minas Gerais, Brazil, Sigma Lithium has its Grota do Cirilo hard-rock lithium project, at which it is currently constructing its Phase 1 operations with expected commissioning by year-end 2022. Sigma anticipates Phase I production of 270,000 metric tons (MT) annually. Additionally, Sigma is constructing its greentech dense media separation production plant, which will make its operations vertically integrated. The company has been recognized by the Bank of America (NYSE:BAC) as part of its “Top 50 Stocks for 10 Scarcity Themes.”

On May 26, Sigma filed a consolidated technical report that looks at two initial production phases for Grota do Cirilo. The integrated operation would source feedstock spodumene ore from the company's Phase 1 and Phase 2 lithium deposits to produce battery-grade, high-purity lithium concentrate. The company pegs the after-tax net production revenue at US$5.1 billion and the after-tax internal rate of return at 589 percent, and states that this expansion scenario "will potentially position (it) as the world’s fourth largest lithium producer." Sigma's share price spiked to its highest point for the first half of the year on May 27, reaching a level of US$18.30.

Most recently, Sigma shared an update on its “transformative” Q2, mentioning the previously announced news that it has increased the resource at Grota do Cirilo by 50 percent; a Phase 3 technical report has now been filed. Additionally, as of the announcement, total construction progress at the project stood at 32 percent. Sigma’s share price climbed through July and August, and after a small drop reached a year-to-date high of US$25 on August 24.

Year-to-date gain: 99.22 percent; market capitalization: US$26.07 billion; current share price: US$101.94

SQM is one of the world’s largest lithium companies. It produces lithium out of Chile’s Salar de Atacama and brings it to the market in the form of lithium carbonate and lithium hydroxide.

SQM is developing the hard-rock Mount Holland lithium project in Australia through a joint venture with Wesfarmers (ASX:WES,OTC Pink:WFAFF). The company places a heavy emphasis on the sustainability of its operations, including a production process that involves 97.4 percent solar energy.

On March 2, SQM released its 2021 earnings report, including net income of US$585.5 million compared to US$164.5 million for 2020. SQM's share price spiked in May to hit US$90.21 on May 18, the same day the company announced both its Q1 earnings report and the approval of an interim dividend payment for investors. Its share price continued to spike through late May, reaching a year-to-date high of US$113.33. On August 17, SQM announced another interim dividend and shared its Q2 and H1 earnings for this year. In H1, the company saw US$1.655 billion in net income, which was an increase of 940 percent over its US$157.8 million net income in H1 2021.

Year-to-date gain: 21.61 percent; market capitalization: US$33.72 billion; current share price: US$287.88

Albemarle is a lithium giant that produces lithium, bromine and catalyst solutions with operations around the world. It has a 49 percent interest in the company whose subsidiary, Talison Lithium, owns and runs the Greenbushes mine, as well as a 60 percent interest in Mineral Resources' (ASX:MIN,OTC Pink:MALRF) Wodgina mine. Both of these are hard-rock lithium mines in Western Australia. The company runs the Silver Peak lithium mine in Nevada, which it calls the only producing lithium mine in North America. The company also creates high-quality lithium products.

Albemarle's share price has spent most of the year down from its US$236.67 start, including a low of US$172.09 in March. However, mid-May saw the company finally make a prolonged break above that level, hitting a year-to-date high of US$270.92 on May 27. The company started the month with the May 4 announcement of its Q1 results, with highlights including a 36 percent year-on-year increase in net sales to US$1.13 billion and increased 2022 guidance. By May 23, the company had announced further increases to its guidance for this year, stating that it expects its adjusted EBITDA to be up more than 160 percent versus the full 2021 year.

On June 13, Albemarle announced the inauguration of its third chemical conversion plant, which it states should double its lithium production, as well as lower water consumption by 30 percent per MT. That started a consistent trend of upward momentum for the company’s share price, which continued through its decision to introduce a dividend, as well as its Q2 results. Highlights include a net sales increase of 91 percent over Q2 2021 and plans to build “integrated lithium operations” in the US. Additionally, its Kemerton I lithium conversion plant saw first production in July. The company’s share price hit a year-to-date high of US$295.68 on August 25.

Nevada Sunrise Gold may have gold in its name, but 2022 has been all about lithium. The explorer wholly owns two lithium projects, the Gemini and Jackson Wash assets, which are located in the Lida Valley basin in Nevada.

According to Nevada Sunrise, the Lida Valley basin shares similar geography to the nearby Clayton Valley basin, where Albemarle’s Silver Peak lithium mine is located. In addition to its lithium properties, the company owns 100 percent of the Coronado VMS project, 20 percent of the Kinsley Mountain gold project and 15 percent of both the Treasure Box copper project and the Lovelock Mine cobalt project.

In the first quarter, Nevada Sunrise Gold’s share price saw little movement, even as it commenced exploration at Gemini. It wasn’t until the company shared its first drill results on April 18 that its share price broke above C$0.10, jumping from C$0.08 to C$0.14 overnight. Further exploration results at the project, including 1,101 parts per million lithium over 730 feet, continued to drive its share price higher.

After rising through May and early June, the company’s share price hit a year-to-date high of C$0.36 on June 10 off the back of June 6 exploration results showing 327.7 milligrams of lithium per liter of water over 220 feet, as well as private placement news. On July 11, the company shared preliminary results from a May time-domain electromagnetic survey. In late July, Nevada Sunrise received an exploration permit for Gemini that amended the number of boreholes to 12, and in mid-August the company announced that it had engaged the drillers for the exploration program. The Phase 2 drill program will begin in September.

Year-to-date gain: 148.78 percent; market capitalization: C$3.05 billion; current share price: C$32.34

For information about Sigma Lithium and what has driven its share price, see its entry in the top US lithium companies section above.

Year-to-date gain: 80 percent; market capitalization: C$18.42 million; current share price: C$0.09

Jourdan Resources is focused on acquiring, exploring and developing hard-rock spodumene lithium projects in Quebec, Canada. Its current projects are the Vallée lithium, Baillarge lithium-molybdenum and Preissac-La Corne lithium projects. According to the company, it has the largest lithium exploration portfolio in Quebec.

Jourdan Resources’ share price saw a spike to start the year — hitting a year-to-date high of C$0.095 — but then fell and performed relatively flatly for much of the first half of the year, staying mostly around C$0.05 to C$0.06. The company’s share price began to rise again in June, during which time it shared exploration results at Vallée, including a highlight of 3.2 meters at 1.56 percent Li2O. Its share price hit C$0.085 in June and again in July.

In July and August, Jourdan has continued to release exploration news at its various projects. On July 7, it shared its latest exploration results at Vallée. Later in the month, the company began a soil sampling program at the Preissac-La Corne and Baillarge projects. In the release, CEO Rene Bharti shared the company’s goals moving forward, saying: “Jourdan is pleased to begin exploration on its other significant properties. The Company is keenly focused on establishing an initial mineral resource estimate at Vallée in the near term and commencing a drill program in the near future at its other two properties, Baillargé and Preissac-La Corne.”

Most recently, Jourdan began drilling at Vallée for its Phase 3 summer drilling program. Just days before that news was released, its share price matched its previous high of C$0.095.

Year-to-date gain: 135.63 percent; market capitalization: AU$2.52 billion; current share price: AU$25.00

According to Core Lithium, its Finniss lithium project in the Northern Territory is “one of Australia’s most capital-efficient and lowest-cost spodumene lithium projects.” First production is expected in the fourth quarter of 2022, and the company already has multiple four year offtake agreements in place with Ganfeng Lithium (SZSE:002460) and Sichuan Yahua Industrial Group (SZSE:002497).

On March 1, Core Lithium announced a four year offtake arrangement with Tesla (NASDAQ:TSLA) for up to 110,000 tonnes of lithium oxide spodumene concentrate from Finniss. Shares saw a spike at the beginning of April following the release of an update on exploration at its Finniss project, and Core hit a year-to-date high of AU$1.60 on April 4. A week later, the company announced that it was acquiring the Shoobridge lithium project near Finniss.

After releasing multiple exploration updates at Finniss throughout the year, the company shared in July that the mineral resource estimate for Finniss had increased by 28 percent to 18.9 million MT at 1.32 percent Li2O. Since then, the company has released further drill results for the BP33 drill hole at Finniss. A sample includes 16 meters at 2.27 percent Li2O, which the company said is “world class.”

In August, Core appointed Gareth Manderson, who has 28 years of experience in the mining industry, as CEO. Later that month, on August 15, it released a wide-ranging exploration update for its various projects. The same day, Core's share price climbed to a year-to-date high of AU$1.62.

Year-to-date gain: 135.63 percent; market capitalization: AU$2.52 billion; current share price: AU$25.00

Sayona Mining (ASX:SYA) is a lithium producer working in Canada and Australia. Alongside Piedmont Lithium (ASX:PLL,NASDAQ:PLL), its strategic partner, the company has acquired North American Lithium, which had a pre-existing lithium mine and concentrator in Quebec, Canada. Sayona has two assets nearby, the Authier and Tansim lithium projects, and it intends to create a Quebec lithium hub to feed the battery supply chain. The company has further lithium projects in Western Australia’s Pilbara region, and it is exploring for gold.

Sayona's share price shot up on April 4 on news that testing of lithium spodumene product from the Authier project shows that it “performs as well as commercially available battery-grade lithium hydroxide.” It continued to climb, reaching a year-to-date high of AU$0.38 on April 19 before beginning to trend back downwards. In late April, the company announced the discovery of a lithium pegmatite zone at the Moblan project.

Sayona has spent the last few months continuing to build up towards the start of production at North American Lithium, including a AU$190 million institutional placement and the building of the team for the project. Sayona and Piedmont approved the restart plan on June 28. As of August 4, 30 percent of plant and equipment upgrades were complete, and first production is anticipated for the first quarter of 2023. The company’s share price has moved back up throughout this news, reaching a Q3 peak of AU$0.30.

Year-to-date gain: 135.63 percent; market capitalization: AU$2.52 billion; current share price: AU$25.00

Xantippe Resources is developing its Carachi lithium project in Argentina after pivoting to focus on what it calls the lithium super trend. The company’s goal is to provide high-purity, battery-quality lithium, and it is acquiring multiple tenements in the Lithium Triangle to accomplish that goal. Xantippe’s land package is located near Lake Resources’ (ASX:LAC,OTCQB:LLKKF) Kachi lithium project. In addition, the company has its Southern Cross gold project in Western Australia, which it is investigating for lithium-bearing pegmatites.

In 2022, Xantippe exercised its option to acquire Carolina Lithium, which gave it access to the Carachi Pampa project. Additionally, it has exercised its options to acquire the Rita and Rita 1 tenements, the La Sofia tenement and the Luz Maria tenement, all expanding the company's footprint in the Lithium Triangle.

Xantippe's share price hit a year-to-date high of AU$0.015 in April. On June 14, Xantippe announced that it had increased its footprint of lithium brine tenements in the country from 12,400 to 21,900 hectares after obtaining options for four more land packages. Later in June, the company obtained exploration and prospecting licenses for the Southern Cross project. The company’s most recent news came on August 30, when it announced it would be conducting a vertical electrical sounding (VES) exploration program at Carachi, and is planning to begin exploration drilling once it has the results of the VES program, as well as drilling permits.

While we don't know how much total lithium is on Earth, the US Geological Survey estimates that global reserves stand at 22 billion MT. Of that, 9.2 billion MT are located in Chile, and 5.7 billion MT are in Australia.

Lithium is mined throughout the world, but the two countries that produce the most are Australia and Chile. Australia's lithium comes from primarily hard-rock deposits, while Chile's comes from lithium brines. Chile is part of the Lithium Triangle alongside Argentina and Bolivia, although those two countries have a lower annual output.

Rounding out the top five lithium-producing countries behind Australia and Chile are China, Argentina and Brazil.

Lithium has a wide variety of applications. While the lithium-ion batteries that power electric vehicles, smartphones and other tech have been making waves, it is also used in pharmaceuticals, ceramics, grease, lubricants and heat-resistant glass. Still, it is largely the electric vehicle industry that is boosting demand.

The lithium price has seen huge success over the past year, and many stocks are up alongside that. It's up to investors to decide if it's time to get in on the market, or if they’ll try to wait for a dip.

A wide variety of analysts are bullish on the market as electric vehicles continue to prosper, and lithium demand from that segment alone is expected to continue to rise. These experts believe the lithium story's strength will continue over the next decades as producers struggle to meet rapidly growing demand.

Unlike many commodities, investors cannot physically hold lithium due to its dangerous properties. However, those looking to get into the lithium market have many options when it comes to how to invest in lithium.

Lithium stocks like those mentioned above could be a good option for investors interested in the space. If you’re looking to diversify instead of focusing on one stock, there is the Global X Lithium & Battery Tech ETF (NYSE:LIT), an exchange-traded fund (ETF) focused on the metal. Experienced investors can also look at lithium futures.

Lithium stocks can be found globally on various exchanges. Through the use of a broker or an investing service such as an app, investors can purchase individual stocks and ETFs that match their investing outlook.

Before buying a lithium stock, potential investors should take time to research the companies they’re considering; they should also decide how many shares will be purchased, and what price they are willing to pay. With many options on the market, it's critical to complete due diligence before making any investment decisions.

It's also important for investors to keep their goals in mind when choosing their investing method. There are many factors to consider when choosing a broker, as well as when looking at investing apps — a few of these include the broker or app's reputation, their fee structure and investment style.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Lauren Kelly, currently hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Nevada Sunrise Gold and Jourdan Resources are clients of the Investing News Network. This article is not paid-for content.

Livent Corporation (NYSE: LTHM) today announced that Gilberto Antoniazzi chief financial officer, will speak at Cowen's 15 th Annual Global Transportation & Sustainable Mobility Conference, being conducted virtually on Wednesday, September 7, 2022 at 1:40 p.m. ET . Live access will be available on the Livent Investor Relations website and via the following link: https:wsw.comwebcastcowen123LTHM2021754 . A replay of the event will also be available via the same link for a period of 90 days.

About Livent

For nearly eight decades, Livent has partnered with its customers to safely and sustainably use lithium to power the world. Livent is one of only a small number of companies with the capability, reputation, and know-how to produce high-quality finished lithium compounds that are helping meet the growing demand for lithium. The company has one of the broadest product portfolios in the industry, powering demand for green energy, modern mobility, the mobile economy, and specialized innovations, including light alloys and lubricants. Livent has a combined workforce of approximately 1,100 full-time, part-time, temporary, and contract employees and operates manufacturing sites in the United States , England , India , China and Argentina . For more information, visit Livent.com .

Media contact: Juan Carlos Cruz +1.215.299.6170

juan.carlos.cruz@livent.com

Investor contact: Daniel Rosen +1.215.299.6208

daniel.rosen@livent.com

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/livents-gilberto-antoniazzi-to-speak-at-the-cowen-15th-annual-global-transportation–sustainable-mobility-conference-301613935.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/livents-gilberto-antoniazzi-to-speak-at-the-cowen-15th-annual-global-transportation–sustainable-mobility-conference-301613935.html

SOURCE Livent Corporation

News Provided by PR Newswire via QuoteMedia

ALBemarle Corporation (NYSE: ALB), a leader in the global specialty chemicals industry, today announced that as a result of its strategic review of the business, ALBemarle has chosen to retain its Catalysts business under a separate, to-be-named entity and wholly owned subsidiary of ALBemarle . This structure is intended to allow the Catalysts business to respond to unique customer needs and global market dynamics more effectively while also achieving its growth ambitions.

In response to the accelerating energy transition, the Catalysts business announced in September 2021 a retooled strategy focused on new geographies in India and Southeast Asia , attractive crude-to-chemical technologies, renewable diesel to serve a larger hydrotreated vegetable oil market, and pyrolysis oil treatment for bio-oil (synthetic) fuel. Albemarle simultaneously announced a strategic review of the Catalysts business to determine the best way to support its strategy for growth.

During the review, Albemarle considered a wide range of value creation opportunities for the Catalysts business including a joint venture with a partner, a spin-off or sale, or Albemarle retaining the business. The company conducted due diligence with multiple parties, including strategic and financial sponsors, but in the end determined that the best value for Albemarle was to hold the business as a separate entity.

"We are confident that there is significant value in the Catalysts business that can address the needs of the evolving global market and create growth for customers, employees, and our shareholders," said Albemarle CEO Kent Masters . "We believe that retaining the business under this new structure is the best path to that outcome."

The process to move the Catalysts business to its new legal structure is underway and is expected to be finalized in approximately 18 months. The business will continue to be led by Raphael Crawford , current president of the Catalysts global business unit.

About Albemarle

ALBemarle Corporation (NYSE: ALB) is a global specialty chemicals company with leading positions in lithium, bromine, and refining catalysts. We think beyond business as usual to power the potential of companies in many of the world's largest and most critical industries, such as energy, electronics, and transportation. We actively pursue a sustainable approach to managing our diverse global footprint of world-class resources. In conjunction with our highly experienced and talented global teams, our deep-seated values, and our collaborative customer relationships, we create value-added and performance-based solutions that enable a safer and more sustainable future.

We regularly post information to www.albemarle.com , including notification of events, news, financial performance, investor presentations and webcasts, non-GAAP reconciliations, SEC filings and other information regarding our company, our businesses, and the markets we serve.

Forward-Looking Statements

Some of the information presented in this press release, including, without limitation, information related to the timing of restructuring the Catalysts business, the benefits and opportunities associated with the restructuring of the Catalysts business, anticipated return on opportunities, and including all information relating to matters that are not historical facts may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from the views expressed. Factors that could cause Albemarle's actual results to differ materially from the outlook expressed or implied in any forward-looking statement include, without limitation: changes in economic and business conditions; changes in financial and operating performance of its major customers and industries and markets served by it; the timing of orders received from customers; the gain or loss of significant customers; fluctuations in lithium market pricing, which could impact our revenues and profitability particularly due to our increased exposure to index-referenced and variable-priced contracts for battery grade lithium sales; changes with respect to contract renegotiations; potential production volume shortfalls; competition from other manufacturers; changes in the demand for its products or the end-user markets in which its products are sold; limitations or prohibitions on the manufacture and sale of its products; availability of raw materials; increases in the cost of raw materials and energy, and its ability to pass through such increases to its customers; technological change and development, changes in its markets in general; fluctuations in foreign currencies; changes in laws and government regulation impacting its operations or its products; the occurrence of regulatory actions, proceedings, claims or litigation (including with respect to the U.S. Foreign Corrupt Practices Act and foreign anti-corruption laws); the occurrence of cyber-security breaches, terrorist attacks, industrial accidents or natural disasters; the effect of climate change, including any regulatory changes to which it might be subject; hazards associated with chemicals manufacturing; the inability to maintain current levels of insurance, including product or premises liability insurance, or the denial of such coverage; political unrest affecting the global economy, including adverse effects from terrorism or hostilities; political instability affecting our manufacturing operations or joint ventures; changes in accounting standards; the inability to achieve results from its global manufacturing cost reduction initiatives as well as its ongoing continuous improvement and rationalization programs; changes in the jurisdictional mix of its earnings and changes in tax laws and rates or interpretation; changes in monetary policies, inflation or interest rates that may impact its ability to raise capital or increase its cost of funds, impact the performance of its pension fund investments and increase its pension expense and funding obligations; volatility and uncertainties in the debt and equity markets; technology or intellectual property infringement, including cyber-security breaches, and other innovation risks; decisions it may make in the future; future acquisition and divestiture transactions, including the ability to successfully execute, operate and integrate acquisitions and divestitures and incurring additional indebtedness; continuing uncertainties as to the duration and impact of the coronavirus (COVID-19) pandemic; performance of Albemarle's partners in joint ventures and other projects; changes in credit ratings; and the other factors detailed from time to time in the reports Albemarle files with the SEC, including those described under "Risk Factors" in Albemarle's most recent Annual Report on Form 10-K any subsequently filed Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this press release. Albemarle assumes no obligation to provide any revisions to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws. ![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/albemarle-concludes-strategic-review-of-catalysts-business-301613386.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/albemarle-concludes-strategic-review-of-catalysts-business-301613386.html

SOURCE Albemarle Corporation

News Provided by PR Newswire via QuoteMedia

HIGHLIGHTS

Philip le Roux, the CEO of Arcadia stated: “Our focus with this drilling program is to test the geological horizons identified from our previously announced grab sampling program and recent comprehensive mapping, which horizons are considered most prospective for mineralisation based on previously received results. Once drilling has been completed, we should know a lot more about the tenor of mineralisation to shallow depths, which may warrant further drilling”.

Drilling Program

The drilling program is expected to consist of 9 drill holes drilled at a 60 degree inclination and at varied azimuths and depths dependent on the inferred geometry and geology of the targeted zone. Dependant on whether visual mineralisation is encountered in drill holes, an additional 3 holes will be drilled. A location map of the planned drill holes is attached hereto as Annexure 2.

On the 7th of September 2021 the Company announced2 results from a grab sampling program over an inferred 20 km x 2 km metasedimentary structural feature (See Figure 1 below). This structure contains similar geology than that encountered at the nearby Navachab Mine (5.3MozAu)3 and by various other explorers for gold mineralisation in the area, such as Osino Resources who developed its Twin Hills prospect4 (located 45km also within the Karibib gold belt) to contain a Mineral Resource of 2.1MozAu.

Results attained from the grab sampling program at Karibib were impressive, and were taken from lithology identified as either Skarn-type or Vein-type mineralisation:

Skarn-type mineralisation returned average copper mineralisation of 4.32 % Cu, with a highest value of 28.40% Cu. Average gold values of 1.49 g/t Au were returned, with a highest value of 7.65 g/t Au. Significant Silver mineralisation was also encountered (av. 50.50 g/t Ag with highest 453 g/t Ag) and up to 1% Tungsten.

Vein-type mineralisation returned average results of 1.94% Cu (highest 5.69% Cu), 2.06 g/t Au (highest 26.30 g/t Au) and 12.68 g/t Ag (highest 30.10 g/t Ag).

Both vein- and skarn-type mineralisation is known to contain economic mineralisation in the area5, and were encountered on or near the contact margins of large diorite intrusions.

Following the receipt of the high-grade sampling results and newly attained knowledge of the geology of the area, the Company conducted follow-up work by identifying locally occurring favourable geological settings which are likely to host diorite-proximal skarn- and vein-type mineralisation suitable for drilling.

Click here for the full ASX Release

This article includes content from Arcadia Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

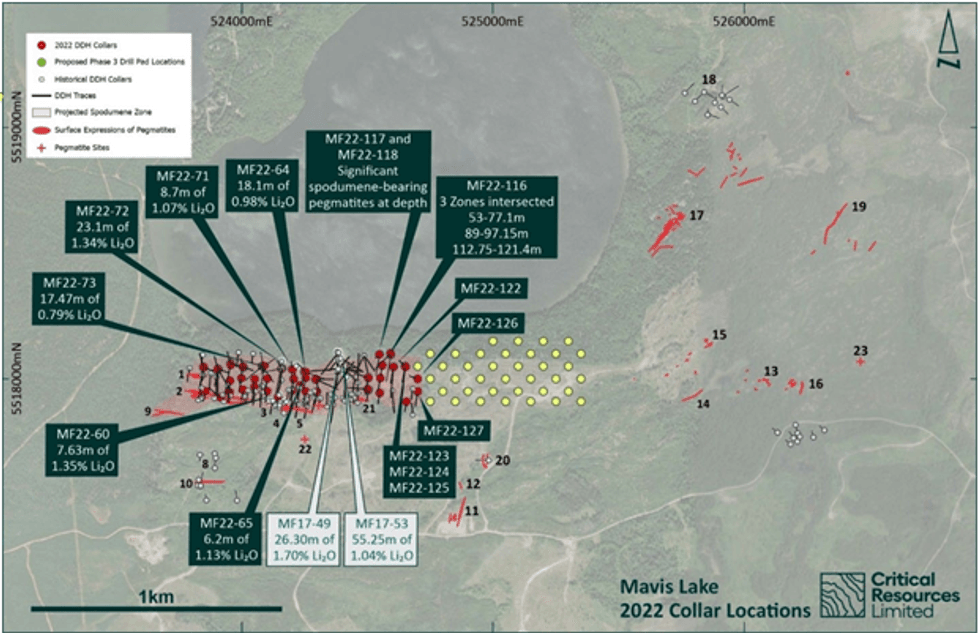

Critical Resources Limited (ASX:CRR) (“Critical Resources” or “the Company”) is pleased to advise that following continued drilling success at Mavis Lake, the Company has approved an extension to its current drilling campaign at the Company’s 100 per cent-owned Mavis Lake Lithium Project (“the Project”) in Ontario, Canada.

Highlights

Figure 1: Plan map of Historic, Active, and Proposed (Phase 3) Drill Collar Locations

Phase 3 drilling was approved after assessing the continued results from Phase 2, where drilling continues to intersect multiple spodumene-bearing pegmatites and strike extension to the east. The abundance of spodumene mineralisation (confirmed through visual assessment) appears to have increased in multiple zones with visual estimates as high as 40% spodumene laths within pegmatite over 6.25m in MF22-1231. Full details on drill holes MF22-122, MF22-123, MF22-124, MF22-125, MF22-126 and MF22-127 can be seen in Appendix 1.

Figure 2: Close up of large white spodumene laths within the zone of MF22-123 from 50.9 to 57.15m downhole

Assay work continues and results will be released as received.

A total of 9,481m of approved drilling has been completed to date, with the Company’s primary focus having been infill drilling and now extension drilling.

Immediate 100m drill-hole spacing will continue to test strike length and down-dip continuity to further delineate the spodumene-bearing pegmatites and underpin the development of a maiden JORC compliant resource.

Critical Resources Chairman Robert Martin commented:

“Having recently been on the ground at Mavis Lake and seeing the results that our in-country geologist, geological consultants and drilling crews are achieving, it was a very easy decision to increase the current program. Having consistently intercepted spodumene-bearing pegmatites and increasing strike length in a previously untested area is an excellent outcome, we believe our phase three program will continue this trend.

We look forward to the phase three drilling program confirming our view that the mineralised zones are continuing to the east, towards an area that has known and mapped pegmatites, providing a potential strike length up to 3km long.

The Company’s confidence in the asset, as we work towards delineating a maiden JORC Compliant Resource, is strong and as such we have began early stage planning and permitting for a Phase Four program.”

Click here for the full ASX Release

This article includes content from Critical Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.