Thomas Barwick

Thomas Barwick

GigaCloud Technology (GCT) has filed to raise $39.4 million in gross proceeds from the sale of its Class A common stock in an IPO, according to an amended registration statement.

The company provides an ecommerce logistics marketplace and related logistics services for businesses needing to deliver large parcel goods.

Growth risks, a low margin business, uncertain Chinese regulatory environment and the potential for continued rolling COVID-19 lockdowns in China make me cautious on GCT.

I’m on Hold for the IPO.

Hong Kong, China-based GigaCloud was founded to develop its GigaCloud Marketplace to bring together manufacturers and resellers via discovery, payment and logistics tools on its online platform.

As of March 31, 2022, the company had 21 large scale warehouses located in the countries of the U.S., Japan, the UK and Germany.

Management is headed by founder, Chairman and CEO Larry Lei Wu, who has been with the firm since inception and was previously general manager of New Oriental Education & Technology Group.

GigaCloud has booked fair market value investment of $65 million as of March 31, 2022 from investors including DCM, JD.com and others.

The firm offers its platform and related inventory via its in-house system as well as through major ecommerce websites.

For the 12 months ended March 31, 2022, the firm had 410 active 3P sellers and 3,782 active buyers who transacted over $438 million in Gross Merchandise Volume [GMV].

Selling and Marketing expenses as a percentage of total revenue have trended lower as revenues have increased, as the figures below indicate:

Selling and Marketing

Expenses vs. Revenue

Period

Percentage

Three Mos. Ended March 31, 2022

4.9%

2021

6.2%

2020

8.1%

(Source – SEC)

The Selling and Marketing efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Marketing spend, dropped to 3.2x in the most recent reporting period, as shown in the table below:

Selling and Marketing

Efficiency Rate

Period

Multiple

Three Mos. Ended March 31, 2022

3.2

2021

5.4

(Source – SEC)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

GCT’s most recent calculation was 26% as of March 31, 2022, so the firm has some ways to go in this regard, per the table below:

Rule of 40

Calculation

Recent Rev. Growth %

19%

EBITDA %

7%

Total

26%

(Source – SEC)

According to a market research report by Frost & Sullivan referenced by the company, the U.S. B2B ecommerce sales market was an estimated $1.3 trillion in 2020 and is expected to reach $2.2 trillion by 2025.

This represents a forecast CAGR of 10.7% from 2020 to 2025.

The main drivers for this expected growth are an increase in smartphone utilization for shopping purposes, emergence of more e-commerce platforms and the availability of alternative payment solutions.

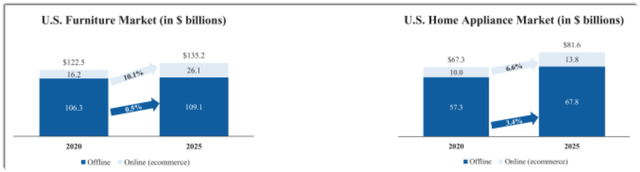

Also, the chart below shows the projected growth trajectory of various large parcel verticals in the U.S. through 2025:

U.S. Large Parcel Online Markets (SEC EDGAR)

U.S. Large Parcel Online Markets (SEC EDGAR)

The firm competes with other ecommerce platforms and 1P providers of large parcel goods worldwide.

The company’s recent financial results can be summarized as follows:

Growing topline revenue, although slowing growth

Reduced gross profit and lower gross margin

Lower operating profit and operating margin

A swing to cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

Total Revenue

Period

Total Revenue

% Variance vs. Prior

Three Mos. Ended March 31, 2022

$ 112,442,000

19.0%

2021

$ 414,197,000

50.4%

2020

$ 275,478,000

Gross Profit (Loss)

Period

Gross Profit (Loss)

% Variance vs. Prior

Three Mos. Ended March 31, 2022

$ 16,870,000

-19.2%

2021

$ 89,597,000

19.3%

2020

$ 75,116,000

Gross Margin

Period

Gross Margin

Three Mos. Ended March 31, 2022

15.00%

2021

21.63%

2020

27.27%

Operating Profit (Loss)

Period

Operating Profit (Loss)

Operating Margin

Three Mos. Ended March 31, 2022

$ 7,481,000

6.7%

2021

$ 39,353,000

9.5%

2020

$ 44,184,000

16.0%

Comprehensive Income (Loss)

Period

Comprehensive Income (Loss)

Comprehensive Margin

Three Mos. Ended March 31, 2022

$ 4,670,000

4.2%

2021

$ 29,380,000

26.1%

2020

$ 37,091,000

33.0%

Cash Flow From Operations

Period

Cash Flow From Operations

Three Mos. Ended March 31, 2022

$ (14,512,000)

2021

$ 8,556,000

2020

$ 33,284,000

(Glossary Of Terms)

(Source – SEC)

As of March 31, 2022, GigaCloud had $49.5 million in cash and $216.5 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2022, was negative ($808,000).

GCT intends to sell 3.5 million shares of Class A common stock at a proposed midpoint price of $11.25 per share for gross proceeds of approximately $39.4 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Class A stockholders will be entitled to one vote per share and Class B shareholders will receive ten votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $377 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 8.6%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

We plan to use the net proceeds of this offering for working capital, operating expenses, capital expenditures and other general corporate purposes including funding potential strategic acquisitions, investments and alliances, although we do not presently have specific plans and are not currently engaged in any discussions or negotiations with respect to any such transaction.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm does not currently have any pending litigation that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is Aegis Capital Corp.

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

Measure [TTM]

Amount

Market Capitalization at IPO

$459,039,893

Enterprise Value

$376,883,893

Price / Sales

1.06

EV / Revenue

0.87

EV / EBITDA

10.40

Earnings Per Share

$0.63

Operating Margin

8.39%

Net Margin

6.04%

Float To Outstanding Shares Ratio

8.58%

Proposed IPO Midpoint Price per Share

$11.25

Net Free Cash Flow

-$808,000

Free Cash Flow Yield Per Share

-0.18%

Debt / EBITDA Multiple

0.01

CapEx Ratio

0.38

Revenue Growth Rate

18.95%

(Glossary Of Terms)

(Source – SEC)

GCT is seeking U.S. public market investment to fund its general, unspecified corporate growth initiatives.

The company’s financials show increasing topline revenue, although at a reduced growth rate in the most recent partial year period, lower gross profit and gross margin, a reduction in operating profit and operating margin and a swing to cash used in operations.

Free cash flow for the twelve months ended March 31, 2022, was negative ($808,000).

Selling and Marketing expenses as a percentage of total revenue have dropped as revenue has increased; its Selling and Marketing efficiency multiple dropped to 3.2x in the most recent reporting period.

The firm currently plans to pay no dividends and plans to retain future earnings to reinvest into its corporate growth initiatives.

The market opportunity for optimizing ecommerce logistics processes is large and expected to grow at a substantial rate as the overall ecommerce market grows in the coming years.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

Aegis Capital is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (77.7%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risks to the company’s outlook are its slowing revenue growth and swing to cash used in operations.

It is difficult to know how much of its topline revenue trajectory slowdown in Q1 2022 was due to COVID-related lockdowns in certain Chinese provinces.

As for valuation, the company is a low net margin business, so despite significant revenue, it is producing low single-digit net margin.

Growth risks, a low margin business, uncertain Chinese regulatory environment and the potential for continued rolling COVID-19 lockdowns in China make me cautious on GCT.

I’m on Hold for the IPO.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I’m the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider’s ‘edge’ on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is intended for educational purposes only and is not financial, legal or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or removed at any time without notice. You should perform your own research for your particular financial situation before making any decisions. IPO investing can involve significant volatility and risk of loss.