DjelicS

DjelicS

Since their inception more than 100 years ago, vehicles have become unbelievably important to the functioning of modern society. They facilitate tremendous growth and reduce the cost of transportation, amongst other things. Naturally, such large and complicated pieces of machinery would require a number of goods and services in order to function optimally. One company that has created a network of outlets dedicated to providing some of these is Murphy USA (NYSE:MUSA). Recent financial data provided by management looks incredibly bullish at this moment. And while the company might be pricey compared to other automotive-oriented firms, it does look cheap enough on an absolute basis that, when combined with growth, should warrant a ‘buy’ rating.

According to the management team at Murphy USA, the company’s operations center largely around the marketing of retail motor fuel products and convenience merchandise through its massive network of retail stores spread across 27 states. Although this may sound vague, the best description that cuts through what management is saying and what the company actually does is to refer to it as a gas station operator. At present, the company has 1,695 retail outlets across the states in which it operates. Of these, 1,151 fall under the Murphy USA brand name while 385 fall under the Murphy Express brand name. The remaining 159 are under a separate operation entirely called QuickChek.

A big part of the company’s business model is to locate its stores near Walmart (WMT) stores. Although this may seem odd at first glance, management believes that the proximity to Walmart stores generates large amounts of traffic to its existing locations while its competitively priced gasoline and convenience store offerings appeal to budget-conscious customers. The company has even gone so far as to collaborate with Walmart on discount fuel programs, mainly Walmart+, in an attempt to further tie its fortunes to the retail chain. This is not to say that the company doesn’t have its own special programs. It also currently offers customers the Murphy Drive Rewards loyalty program which rewards customers with discounted and free items based on purchases of qualifying fuel and merchandise.

Generally speaking, the stores the company has are fairly small. Both the Murphy USA and Murphy Express retail gasoline stores focus largely on providing fuel to customers and, given the nature of that focus, they have largely buildout stores that are between 1,400 and 2,800 square feet in size. In fact, the company helps to keep costs down with this method, not only requiring a small amount of real estate but also rarely necessitating more than one or two associates to be present during regular business hours. The newer QuickChek stores came to the company in early 2021 as a result of its acquisition of the enterprise for $641.1 million. These stores are usually between 5,000 and 7,000 square feet in size and serve as convenience stores that emphasize the sale of food and beverage products.

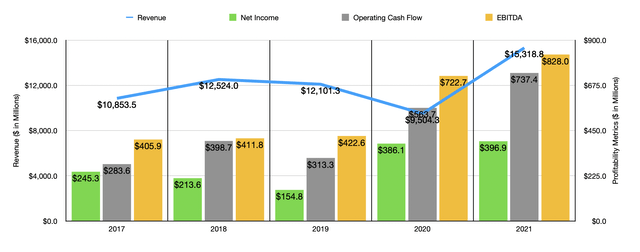

Author – SEC EDGAR Data

Author – SEC EDGAR Data

Financial performance achieved by Murphy USA has been a bit volatile over the years. Take revenue. Between 2017 and 2018, sales at the company grew from $10.85 billion to $12.52 billion. Sales then dropped to $12.10 billion in 2019 before plunging to $9.50 billion in 2020 because of the COVID-19 pandemic. But then, in 2021, sales came in strong at $15.32 billion. The sizable increase in revenue between 2020 and 2021, amounting to $6.1 billion in all, was driven by a mixture of factors, such as higher average retail fuel prices, retail fuel volumes that grew by 11.6%, merchandise sales growth of 24.5%, and other related factors, largely attributed to its acquisition of QuickChek. It is worth noting that, even without the aforementioned acquisition, the company has demonstrated growth in its store footprint. From 2017 to 2020, the number of outlets that it had in its portfolio grew from 1,446 to 1,503.

Profitability has also been rather volatile. Net income fell year after year between 2017 and 2019, dropping from $245.3 million to $154.8 million. In 2020, profits skyrocketed to $386.1 million before rising further to $396.9 million last year. Operating cash flow has also been a bit lumpy from year to year, staying in a range of between $283.6 million and $398.7 million in the three years ending in 2019. In 2020, cash flow came in at $563.7 million. And in 2021, it rose further to $737.4 million. The only metric that has been really consistent from year to year in terms of a trajectory is EBITDA. It rose from $405.9 million in 2017 to $422.6 million in 2019. In 2020, it rose further to $722.7 million before jumping to $828 million in 2021.

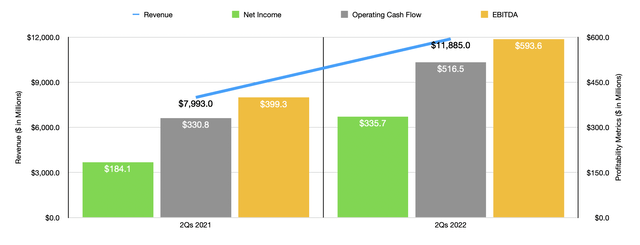

Author – SEC EDGAR Data

Author – SEC EDGAR Data

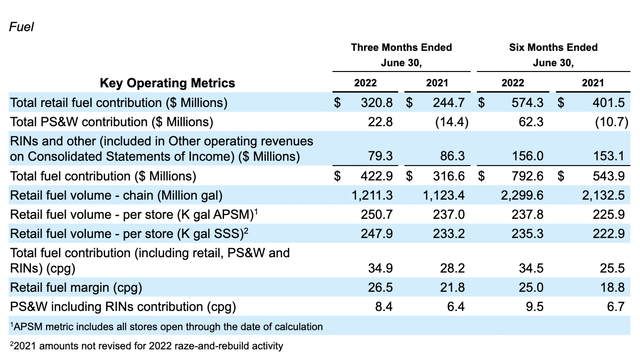

So far, the 2022 fiscal year is looking quite bright for the business. Sales in the first half of the year came in at $11.89 billion. This dwarfs the $7.99 billion generated the same time one year earlier. In addition to benefiting from an extra month of owning QuickChek, the company also benefited during this timeframe from the addition of 33 stores year-over-year and from an increase in retail fuel volume at all of its locations climbing from 2.13 billion gallons to nearly 2.30 billion gallons. Slightly higher merchandise sales also helped the company during this time.

On the bottom line, we also saw some significant improvement. Net income rose from $184.1 million in the first half of 2021 to $335.7 million to the same time this year. Operating cash flow grew from $330.8 million to $516.5 million. Meanwhile, EBITDA for the company also expanded, rising from $399.3 million to $593.6 million. Naturally, the increase in revenue helped the company on this front. But it also benefited from an increase in its retail fuel margin from 18.8% to 25%.

When it comes to the 2022 fiscal year as a whole, management has been somewhat vague. They did say that they plan to add up to 45 new stores to their portfolio. So far, they have only added 16 through the first half of the year. They also plan to remodel up to 35 locations. Beyond that, what guidance they offered was not all that valuable. But if we were to annualize results that we saw during the first half of the year, we would end up with net income of $723.7 million, operating cash flow of $1.15 billion, and EBITDA of $1.23 billion.

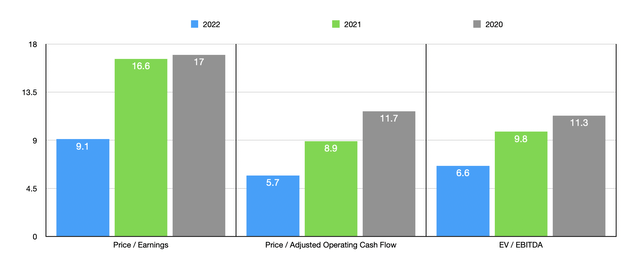

Author – SEC EDGAR Data

Author – SEC EDGAR Data

Using this data, we can easily value the company. The price to earnings multiple of the firm, on a forward basis, should be roughly 9.1. The price to operating cash flow multiple is 5.7 while the EV to EBITDA multiple has been calculated at 6.6. As you can see in the chart above, this pricing is more attractive than if the company was priced based on data from 2021 or even 2020. Some market participants might be skeptical, however, of the company’s ability to continue with the strong cash flows that it has achieved. To see what I mean, you need to only look at the fuel margins the company has realized over the past few years, shown in the image below.

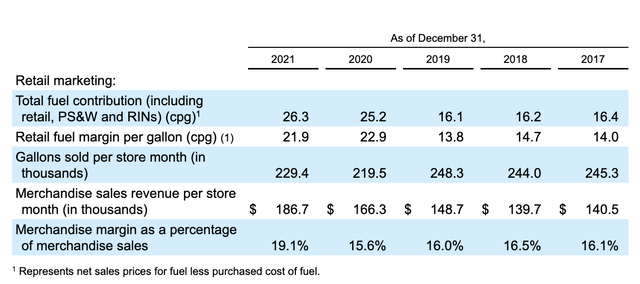

Murphy USA

Murphy USA

Murphy USA

Murphy USA

Generally speaking, in a typical environment, lower wholesale pricing of fuel would result in stronger margins for a company like Murphy USA. But recently, high pricing has not prohibited the company from generating strong margins and has actually made it possible for their margins to grow more than what would have otherwise been anticipated. If this seems contradictory, it is because it sort of is. Having said that, management believes that the future for the company, from a profitability perspective, is quite bright. This is due to the fact that the COVID-19 pandemic resulted in tremendous demand destruction initially that increased breakeven unit costs for weaker retailers in the space. Low Street prices then created a favorable environment that allowed the company to pass through higher costs to its customers. But even though the COVID-19 pandemic is basically over, management does believe that headwinds will still exist for weaker retailers because of inflation and low demand while Murphy USA’s market share growth and increased efficiencies should help it to realize stronger margins as the future equilibrium for margins settles at permanently higher levels. Also helping the company should be its continued low-cost model, such as the limited reliance on labor costs and the fact that, relative to similar players, its interest expense should be fairly low on a percentage of sales basis.

Given where we are from a pricing perspective, I do believe that the company looks quite affordable, even if financial performance were to revert back to levels seen in 2020. However, the pricing of the company relative to similar players is a bit different. But, of course, this comes with a caveat. Given the options that we have in the market, I really was forced to compare the company to general automotive retailers. Although I was able to put TravelCenters of America (TA), which relies on fuel revenue, into the equation as a comparable. On a price-to-earnings basis, these companies ranged from a low of 4.7 to a high of 7.6. And when it comes to the EV to EBITDA approach, the range was from 2.8 to 6. In both cases, Murphy USA was the most expensive of the group. Having said that, using the price to operating cash flow approach, the range was between 3.2 and 26.9, with three of the five companies being cheaper than our prospect.

Although shares of Murphy USA might be expensive relative to similar players, the stock does look affordable on an absolute basis. Recent revenue and profitability growth has been incredibly impressive, and management believes that the future for the enterprise is bright. While this picture could definitely change, we have no evidence to suggest that it might. So given these circumstances, I feel comfortable rating the company a soft ‘buy’ at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is currently the manager of Avaring Capital Advisors, LLC, a registered investment advisor that oversees one hedge fund, and he runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham’s investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.