https://arab.news/5xdty

CAIRO: With 70 percent of the world’s desalination plants located in the Middle East, the sector needs innovation driven by entrepreneurial talent.

Nearly two-thirds of the region’s population live in areas lacking sufficient renewable water sources. Some countries in the Middle East rely on water desalination to produce up to 90 percent of drinking water.

Moreover, water desalination requires vast amounts of energy to complete the process, and the role of innovation is starting to increase in reducing the operational cost and environmental impact caused by water issues.

Abu Dhabi-based startup Manhat is already pitching in to decrease the environmental impact with its patented solar energy-based water desalination products.

• Abu Dhabi-based startup Manhat is already pitching in to decrease the environmental impact with its patented solar energy-based water desalination products.

• The company’s technology is based on placing sealed constructs on open water surfaces where water evaporates due to solar radiation.

The company’s technology is based on placing sealed constructs on open water surfaces where water evaporates due to solar radiation.

“Our technology mimics the natural water cycle with zero carbon footprint or brine rejection. The water can be immediately used to irrigate crops which will benefit coastal countries and mitigate the looming threat of rising sea levels due to climate change,” Saeed Alhassan, founder of Manhat, said in a statement.

Global desalination plants are expected to emit 218 million tons of carbon dioxide annually by 2040, which calls for the importance of government and private sector investments in solutions for the water industry.

In a report by the Clean Energy Business Council in the Middle East and North African region, several barriers arise for startups trying to enter the clean-tech industry.

The report indicates that governmental barriers play a huge role in shaping the ecosystem. Firstly, the region’s regulatory structure limits entrepreneurs’ ability to explore new opportunities in the sector.

In addition to complex administration and market barriers, the region needs a regulatory framework that will spur innovation and privatization of the sector.

Moreover, venture capital investments made into startups in the industry are also meager compared to other sectors like e-commerce and fintech.

The report calls out to venture capitalists to start recognizing the potential opportunities that regional startups might offer by building innovation hubs within universities.

Saudi Arabia is one of the countries in the region that has seen startups grow out of universities like water desalination company, QualSens.

QualSens was established at King Abdullah University of Science and Technology as it aims to monitor and enhance the water desalination process using its technology.

“We combined different approaches to building a smart sensor that detects and identifies the fouling developed in the system and helps the operator mitigate it. The objective is to decrease the energy demand required for the production of drinking water,” Luca Fortunato, Co-founder of QualSens, said in a statement.

Although startups are still far from impacting the water desalination sector in the Middle East, governments and large corporations are starting to recognize the importance of innovation for sustainable water production.

Paddy Padmanathan, the CEO of ACWA Power, one of the largest water desalination companies in the region, had said earlier that innovation and entrepreneurship would play a crucial role in addressing the looming water crisis.

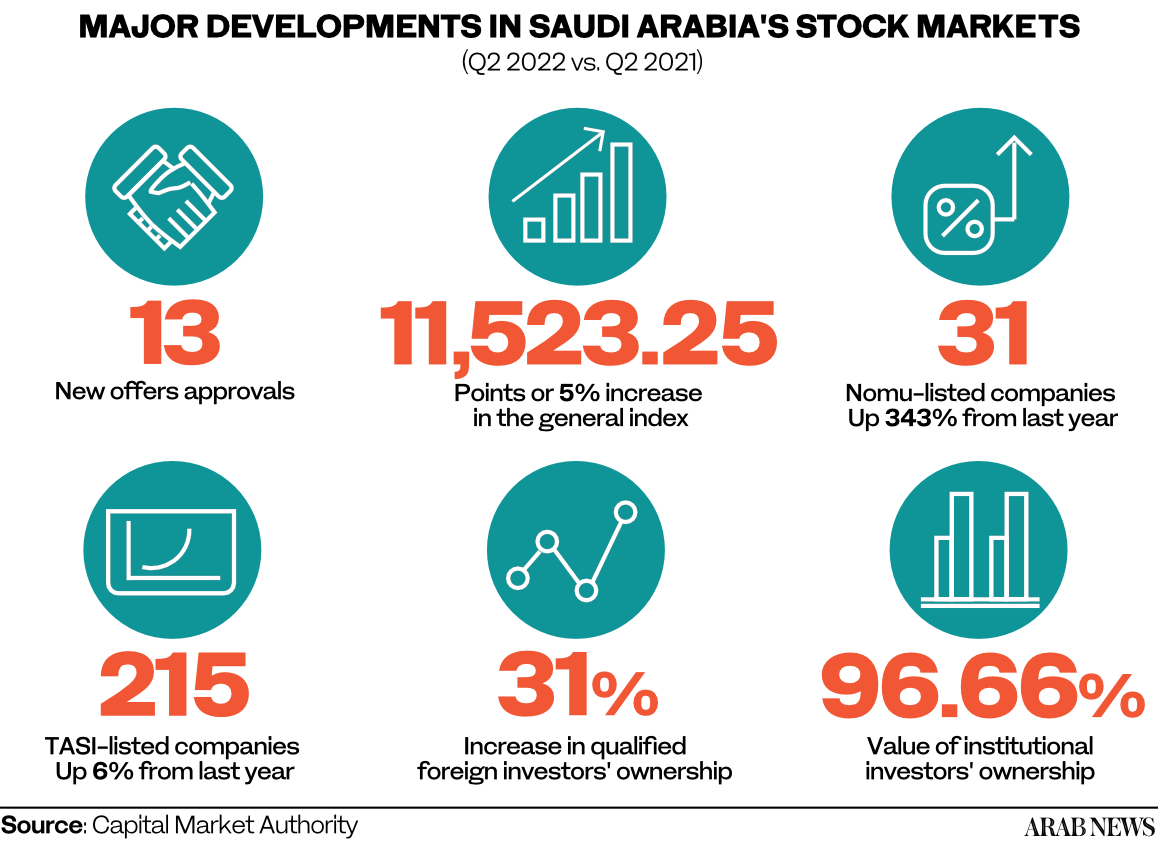

RIYADH: Saudi Arabia’s stock market has been witnessing a wave of new listings since the beginning of the year reaching 246 by the end of the second quarter of 2022.

Listed firms on the main index, Tadawul All Share Index, rose 6 percent to 215, while the remaining 31 were on the parallel Nomu market, revealed a report by the Capital Market Authority.

Nomu, which offers lighter listing requirements, saw a 343 percent surge in the number of companies joining the index in the three-month period compared to the last year.

The report highlighted that approvals for new offers on Tadawul reached 13 during the quarter.

In terms of index performance, TASI recorded an increase of 5 percent on the year to end the quarter at 11,523.25 points.

The total number of individuals with ownership in the Saudi stock market was 5.67 million at the end of the three-month period, while the number of portfolios held rose to 10.8 million from 10.1 million in the prior quarter.

Qualified foreign investor ownership alone surged to SR284 billion ($76 billion) in the same period, up 31 percent from SR216 billion a year earlier.

When it comes to total foreign investment by swap holders, foreign residents, QFI, foreign diversified portfolio managers, and foreign strategic investors, the ownership rose to SR354 billion at the end of the second quarter from SR276 billion a year ago.

Overall institutional investors held 96.6 percent of the total ownership in the market of SR11.4 trillion, while the remaining 3.34 percent belonged to non-institutional investors at the end of the three-month period.

For investment funds, Saudi public funds’ assets dropped 29 percent in value during the second quarter this year compared to 2021, as they invested less in money markets.

Assets’ value decreased to SR193 billion from SR242 billion in the corresponding period in 2021.

The decrease was mainly driven by a decline in the value invested by funds in money market instruments to SR101 billion, holding the highest share of funds’ assets.

The value of assets in this investment category dropped 35 percent from SR155 billion in the prior-year period, despite the addition of a new money market fund this year.

Equities of public funds slightly fell in value to SR24 billion from SR25 billion year-on-year, while debt instruments went up to SR26.9 billion from SR25.6 billion.

The total value captures investment across different asset classes including equities, debt, money market instruments, real estate, exchange-traded funds, funds of funds, real estate investment trusts, endowments, multi-asset, and others.

CAPE TOWN: French independent power producer HDF Energy expects its green hydrogen power plant in Namibia, Africa’s first, to start producing electricity by 2024, a senior company executive said on Monday.

Once operational, the 3.1 billion Namibian dollar ($181.25 million) Swakopmund project will supply clean electricity power, 24 hours a day all-year round, boosting electricity supply in the southern African nation that imports around 40 percent of its power from neighboring South Africa.

Namibia, one of the world’s sunniest and least densely populated countries, wants to harness its vast potential for solar and wind energy to produce green hydrogen and position the country as a renewable energy hub in Africa. Hydrogen is categorized “green” when it is made with renewable power and is seen as key to help decarbonize industry, though the technology remains immature and relatively costly.

The project will see 85 MW of solar panels powering electrolyzers to produce hydrogen that can be stored.

“Yearly we can produce 142 GWh, enough for 142,000 inhabitants and that is conservative,” said Nicolas Lecomte, HDF Energy director for southern Africa.

HDF Energy is also eyeing new projects across Africa and other parts of the world. “Soon after southern Africa you will see HDF developing projects in east Africa,” Lecomte told Reuters.

The EU also plans a deal with Namibia to support the country’s nascent green hydrogen sector and boost its own imports of the fuel, EU and Namibian officials said, as the bloc works to reduce its dependence on Russian energy.

Another company, Namibian-registered Hyphen Hydrogen Energy, is in talks with the country’s government to secure an implementation agreement for its planned $10 billion green hydrogen project that will produce some 350,000 tons of green hydrogen a year before 2030 for global and regional markets.

NEW YORK: Oil prices rose on Monday, shaking off weaker demand expectations as supply concerns mount heading into the winter.

Brent crude futures rose $1.51, or 1.6 percent, to $94.35 a barrel by 12:42 p.m. EDT (1642 GMT). US West Texas Intermediate crude was up $1.28, or 1.5 percent, at $88.07.

US emergency oil stocks fell 8.4 million barrels to 434.1 million barrels in the week ended Sept. 9, its lowest since October 1984, according to data released on Monday by the US Department of Energy.

US President Joe Biden in March set a plan to release 1 million barrels per day over six months from the Strategic Petroleum Reserve to tackle high US fuel prices, which have contributed to soaring inflation.

The Biden administration is weighing the need for further SPR releases after the current program ends in October, Energy Secretary Jennifer Granholm told Reuters last week.

Global oil supply is expected to tighten further when a European Union embargo on Russian oil takes effect on Dec. 5.

The G7 will implement a price cap on Russian oil to limit the country’s oil export revenue, seeking to punish Moscow over the invasion of Ukraine, while taking measures to ensure that oil could still flow to emerging nations.

The US Treasury, however, warned that the cap could send oil and U.S. gasoline prices even higher this winter.

The EU’s executive European Commission is due on Wednesday to unveil a package of measures to help power firms facing a liquidity crunch.

France, Britain and Germany also on Saturday said they had “serious doubts” about Iran’s intentions to revive a nuclear deal. Failure to revive the 2015 deal would keep Iranian oil off the market and keep global supply tight.

In more bearish news for markets, China’s oil demand could contract for the first time in two decades this year as Beijing’s zero-COVID policy keeps people at home during holidays and reduces fuel consumption.

The European Central Bank and US Federal Reserve, meanwhile, are prepared to increase interest rates further to tackle inflation, which could strengthen the US currency and make dollar-denominated oil more expensive for investors.

PARIS: Ukraine’s grain maize (corn) harvest is expected to fall 24 percent below last year and 5 percent below the five-year average to 32 million tons, the EU’s crop monitoring unit MARS said on Monday in updated estimates for the war-torn country.

For sunflower, of which Ukraine is one of the world’s largest exporters, the harvest is expected to drop 15 percent from a year ago to 13.9 million tons, 2 percent below the five-year average.

“Russia’s war against Ukraine has seen a decrease in the area under grain maize and sunflowers. Consequently, our production forecasts for both crops is below the 5-year average, despite fair yield outlooks,” it said in a report.

Some 4 percent of the grain maize, 10 percent of the sunflowers, and 7 percent of soybean production is in areas currently subject to hostilities, MARS said.

For winter crops, for which the harvest is over, the share is at 22 percent of total soft wheat production, 20 percent for barley and 13 percent for rapeseed.

Analysts have been wrestling with how much grain Ukraine, usually one of the world’s biggest suppliers, will be able to harvest and export this year as war with Russia continues.

MARS’ estimates are based its own yield estimates and on area data from the Ukrainian Farm Ministry, apart from those in the war zones of Donetsk, Kherson, Luhansk and Zaporizhzhia, which are based on remote sensing, it said.

RIYADH: The Public Investment Fund-owned ACWA Power on Monday signed an industrial development agreement with Water Global Access, a research and technology development firm, to integrate hydraulic injection desalination, HID, technology at scale.

The deal was signed on the sidelines of the Future of Desalination International Conference in Riyadh.

The agreement comes six months after both companies signed a collaboration agreement to develop a roadmap for HID across ACWA Power’s projects, said a press release.

The agreement will involve the implementation of a pilot project that includes HID in the Gulf Cooperation Council region, following research that has demonstrated that the technology has the potential to break the 2 kWhr barrier of energy consumption to produce 1 cubic meter of water from seawater.

“With continued industrialization and demographic growth, water consumption across the world continues to rise at a rapid rate requiring urgent solutions. The potential emanating from water production utilizing cost effective, low carbon-intensive technologies is truly exponential and we are proud to pilot the ground-breaking HID technology, which is going to be a giant step forward in revolutionizing the desalination industry,” said Paddy Padmanathan, vice chairman and CEO of ACWA Power.

Energy consumption in desalination plants is also referred to as the total specific energy consumption.

“With its low energy footprint, HID technology has the potential to lower operational costs for our desalination business, which we hope will lead to lower tariffs in the long term. For governments, this means that it is more affordable to produce water. For investors, this could mean higher profits per facility. And for communities, it means that they are getting usable water with the least impact on the environment.” he added

“Technical readiness tests confirm that the capacity of HID to break the 2kWh/m3 seawater desalination threshold, opening a new paradigm in the industry’s efficiency levels,” WGA CEO Eusebi Nomen.

“We also welcome ACWA Power’s commitment in this technology, which further cements their position as a global leader in high impact water innovation,” he added.