https://arab.news/4wkfb

DUBAI: Dubai Business Events, Dubai’s official convention bureau, registered 99 successful bid wins during the first six months of 2022, according to Emirates News Agency WAM.

As a result, the events are expected to attract around 77,000 delegates and generate approximately 330,000 hotel room nights, WAM said.

These bid wins will boost Dubai’s events, hospitality, and related tourism sectors as well as advance the broader economy by bringing expertise from around the world, the news agency added.

DBE submitted 200 bids and proposals for international business events in the first half, with several bids still pending.

As of now, Dubai has won several successful events in 2022, including the World Confederation of Physical Therapy Congress in 2023, the IFOS ENT World Congress in 2023, the Asia Pacific Orthopaedic Association Congress in 2024, and the International Congress of Endocrinology in 2024.

In addition, Sun Pharmaceuticals Industries’ Annual Convention and Incentive in 2022 and IBM Best in Tech in 2023 will be hosted in Dubai.

DOF supports Al Khair Courts with $38K

Dubai’s Department of Finance has provided financial support to the Al Khair Courts, Dubai Courts initiative, which aims to alleviate the suffering of debtors and payment defaulters, Dubai Media Office reported.

In support of the Al Khair Courts initiative, the department provided over 141,000 dirhams ($38,000) from the proceeds of the Dirham Al Khair initiative, according to DOF Director General Abdulrahman Saleh Al-Saleh.

Since its launch in 2017, Al-Saleh added, Dirham Al Khair has generated more than 7.5 million dirhams. “Hundreds of UAE citizens benefited from the initiative proceeds through eight governmental and government-supported entities,” he added.

This announcement coincides with World Humanitarian Day, which is observed every year on Aug. 19.

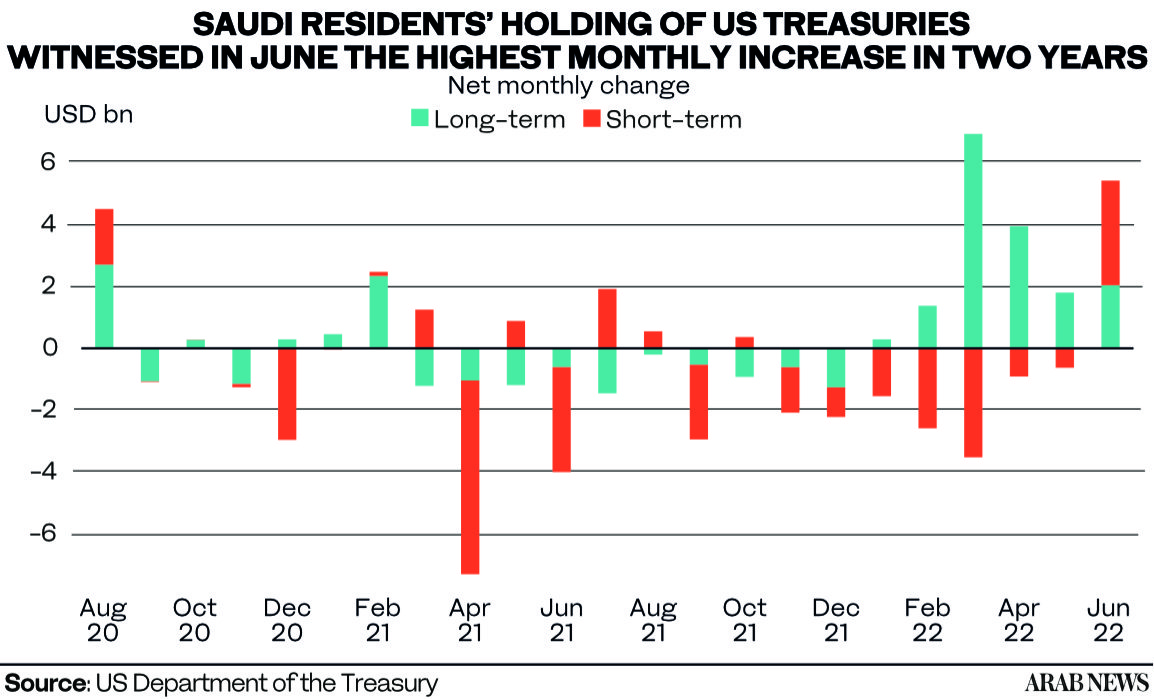

CAIRO: The total value of US Treasuries held by Saudi residents in June increased to $119.2 billion from $114.7 billion in May, according to data from the US Department of the Treasury.

The data showed that the month-on-month rise in US Treasuries had been the highest since August 2020, contrary to the trend seen in the year’s first half.

In January, the US Treasuries holdings totaled $119.4 billion and have seen a general downward trend in the months leading up to June.

It fell to $116.7 billion in February and $115.5 billion in March. It slightly rose to $115.7 billion in April yet dipped to $114.7 billion in May.

Saudi-held long-term Treasuries that have maturities of more than one year rose from $99.3 billion in May to $102 billion in June.

Short-term Treasuries with maturities less than one year, also known as US Treasury bills, grew from $15.3 billion in May to $17.1 billion in June.

While the rate of the Kingdom’s public debt has slowed, the government still spends around $2 billion a quarter to service them, around a third of which is external debt.

The level of debt financing expenses that the Kingdom should pay to service its public debt totaled $2 billion between April and June, up from $1.8 trillion between January and March, reported the Ministry of Finance.

In 2021, these expenses amounted to $1.5 billion in the first quarter, increased to $2 billion in the second, went down to $1.7 billion in the third and concluded the year with $2 billion.

On the other hand, the country’s quickly rising revenue over the past two quarters aided the government in boosting reserves. As a result, it could more than cover the additional government spending in the second quarter of 2022.

According to the Ministry of Finance, the Kingdom’s total revenue amounted to over $98.7 billion in the second quarter of 2022, while total expenditures totaled $78 billion.

The Saudi Central Bank’s recent data pointed out that deposits of government and government-supported institutions rose by $9.8 billion in June to $181.9 billion.

The figure rose further in July to over $186 billion.

These deposits were the highest amount recorded since September 2019.

“The key indicator is the trajectory for more US interest rate rises, especially in the medium-term,” London-based consultant and former professor Mohamed Ramady told Arab News while explaining the outlook for Saudi holding of US Treasuries.

He added: “The US government could try and borrow more in the short- and medium-term at albeit higher interest rates, rather than assume higher priced long-term debt.”

The largest foreign owner of US debt is China, even though its US Treasuries holdings fell for the seventh month in a row in June.

China’s US government debt fell to $967.8 billion in June while remaining on top of the list of US debt owners.

“The role of Saudi Arabia in the US Treasuries market appears to be one of counterbalance and stability,” according to a release by the Euro-Gulf Information Center.

“Buying chunks of US debt means reducing the power of China and possibly the influence of other hostile actors,” continued the release.

RIYADH: Saudi Arabia’s point-of-sale transactions increased 16 percent to SR13.5 million ($3.59 million) in the week ending Sept. 3 compared to SR11.6 million clocked in the week ending Aug. 27, reported the Saudi Central Bank, also known as SAMA.

The rise was mainly driven by an SR512.8 million increase in the value of food and beverage transactions, up 32.4 percent from the previous week.

The healthcare sector had the second largest increase in POS transaction value which amounted to SR176.5 million, increasing by 26.2 percent from the earlier week.

Gas stations came next with a rise of SR122.7 million worth of POS transactions in the week ending Sept. 3, showing an 18.5 percent rise week on week.

Though the scope of categories such as “other sectors” and “miscellaneous goods and services” could not be ascertained, these categories increased by SR327.5 million and SR264.8 million, respectively, during the period under review. However, hotels, clothing and footwear categories declined POS transactions in the week ending Sept. 3.

While hotel transactions declined by 13.3 percent or SR33.5 million, POS purchases of clothing and footwear fell by 7.9 percent or SR75.3 million, the SAMA data showed.

The Kingdom’s overall POS transactions rose 13.9 percent to 162,486 in the week ending Sept. 3 from 142,781 in the week ending Aug. 27.

According to SAMA, the number of POS transactions for food and beverages increased 14.2 percent to 37,577 in the week ending Sept. 3 from 32,917 a week earlier.

Restaurants and cafes came in next with an 11.5 percent rise; they increased by 4,541 in the week ending Sept. 3, amounting to a total number of POS transactions of 44,015.

“Other sectors” and “miscellaneous goods and services” followed with total POS transactions up by 3,023 and 2,551, respectively.

The POS values of hotels, clothing and footwear dropped in the number of transactions by 9.5 and 2.6 percent, respectively, compared to the previous week.

Riyadh led the Kingdom’s POS transactions with 43,127 transactions with a value of SR4.2 million in the week ending on Sept. 3, both up 13.1 percent from the week before.

The city with the most significant percentage jump in both the value and number of POS transactions was Tabuk.

The week-on-week change in Tabuk’s value of POS transactions was 41.7 percent, whereas the number of POS transactions increased by 28.3 percent.

Saudi Arabia’s aggregate POS transactions may have increased by SR10.7 billion in August, reaching SR56.4 billion, data compiled by Arab News from the SAMA weekly show.

The number of POS transactions may have risen by 120 million in August, reaching 732.3 million, up from 611.5 million in July.

The August data compiled by Arab News is based on the weekly reports from July 31 to Sept. 3. Therefore, the actual numbers might differ.

CAIRO: The European Bank for Reconstruction and Development will help finance the decommissioning of 5GW of inefficient gas-fired power plants in Egypt from 2023 while pledging up to $1 billion for renewables, its regional director said on Sunday.

EBRD would raise up to $300 million in sovereign financing for projects including work to stabilize Egypt’s grid, adding battery storage, developing the local supply chain for renewables, and retraining workers, said Heike Harmgart, EBRD’s managing director for the Southern and Eastern Mediterranean.

A separate $1 billion pledged for renewables would be about one tenth of the private funding needed for 10GW of mainly wind-powered projects planned by the government by 2028, she added.

Egypt is a natural gas producer that is trying to cut down on domestic consumption so that it can export more to Europe at a time of high prices and demand resulting from Russia’s invasion of Ukraine.

It has a power surplus after installing three huge gas-fired power plants built by Siemens from 2015.

The government is hoping gas exports can help contain pressure on Egypt’s currency after the Ukraine war triggered the latest dip in dollar inflows from portfolio investment and tourism.

As host of COP27, Egypt is giving a voice to some African states that want to continue using gas as a transition fuel to develop their economies.

About 3GW of the planned 10GW of new renewable power would be made available for a pilot phase in the production of green hydrogen in Egypt’s Red Sea port of Ain Sokhna, Harmgart said.

Some would go to replacing capacity lost through the decommissioning of the thermal power plants.

Egypt has announced a string of memorandums of understanding for green hydrogen and ammonia projects at Ain Sokhna.

RIYADH: Assets under management by institutions licensed by Saudi Arabia’s Capital Market Authority increased by 8 percent to reach SR757 billion ($201 billion) by the end of the second quarter compared to SR703 billion during the same period in 2021, said a report.

The report issued by the Capital Market Authority provides detailed data on the entities that are subject to the authority’s supervision.

The infrastructure institutions and fintech companies under the authority achieved Saudization rates of 89 percent and 80 percent respectively, the data showed.

The report aims at promoting confidence and raising the level of transparency and disclosure in the capital market, in addition to helping researchers and followers of the capital market by providing services of accessing detailed data on the sector, its activities and variables.

The report showed that 11 companies received the Financial Technology Experimental Permit (FinTech ExPermit), while the applications for FinTech ExPermit climbed to 20 applications in the second quarter of the current year, compared to only 4 applications by the same period of 2021.

The report provides detailed data on the entities under the supervision of CMA including workforce, financial adequacy in the practices of operations, management and custody, value of brokers’ trading in the Saudi capital market, public and private funds, complaint data and availability of brokerage service.

RIYADH: The global oil demand is expected to increase over the third quarter to approximately 100.6 million barrels per day, according to a report on petroleum developments in global markets issued by the Organization of Arab Petroleum Exporting Countries.

This is in line with expectations that the Organisation for Economic Co-operation and Development group’s demand would rise to about 47 million bpd, and the rest of the world’s demand would rise to about 53.6 million bpd.

This is also despite the fact that preliminary estimates indicate global oil demand fell to about 98.3 million bpd during the second quarter, down by 1 percent from the same period last year.

The report also revealed that OECD demand fell 0.7 percent during the second quarter to about 45.5 million bpd, whereas the remainder of the world’s demand fell 1.2 percent to about 52.8 million bpd.

The monthly average price of OPEC crude oil fell to $108.32 per barrel in July 2022, about 8 percent below the previous month.

OPEC has projected that in 2022 the common annual value of a basket of crude oil will rise to $105.71, an increase of 51.3 percent over the previous year.

The report indicated that the common value of an OPEC crude oil basket reached $117.7 per barrel in June 2022, up 3.3 percent compared with May 2022.

This is primarily due to strong fundamentals in the oil market, high refiner demand, high profit margins, as well as supply disruptions in several key production areas, such as Libya and Ecuador.