Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders.

Trade your opinion of the world’s largest markets with low spreads and enhanced execution.

With FXCM, education isn’t an additional expense: it is part of your investment.

Economic education that matters. Market Insights is your source for information in the investment world.

View All Insights

FXCM is a leading provider of online foreign exchange (FX) trading, CFD trading and related services.

Login

The technology sector and growth stocks are sensitive to the current high interest rates environment, which has led to very poor year, as the US Fed has been aggressively tightening its policy.

After July’s second straight historic 0.75% rate increase, the central bank abandoned forward guidance and pivoted to a data-dependent approach, while Chair Powell had hinted to a potentially slower pace in the future but at the same time keeping the door open to more outsized hikes. [1]

Markets got it to their head that this the Fed would soon change tack and become less aggressive, which allowed the NAS100 to stage a notable recovery in July. This proved short-lived however, as policy makers refocused the public discourse on their resolve to bring inflation down and maintain their hawkish stance.

Yesterday’s surge in core CPI shattered recent optimism for a peak in inflation and markets now see possibility for an even bigger move on rates by the central bank during the upcoming meeting next week.

Learn More

This led to sell-off in the stock market, with tech-heavy NAS100 posting its worst day since March 2020 and the height of the COVID-19 outbreak, while FXCM’s FAANG Stock Basket shed nearly 7%.

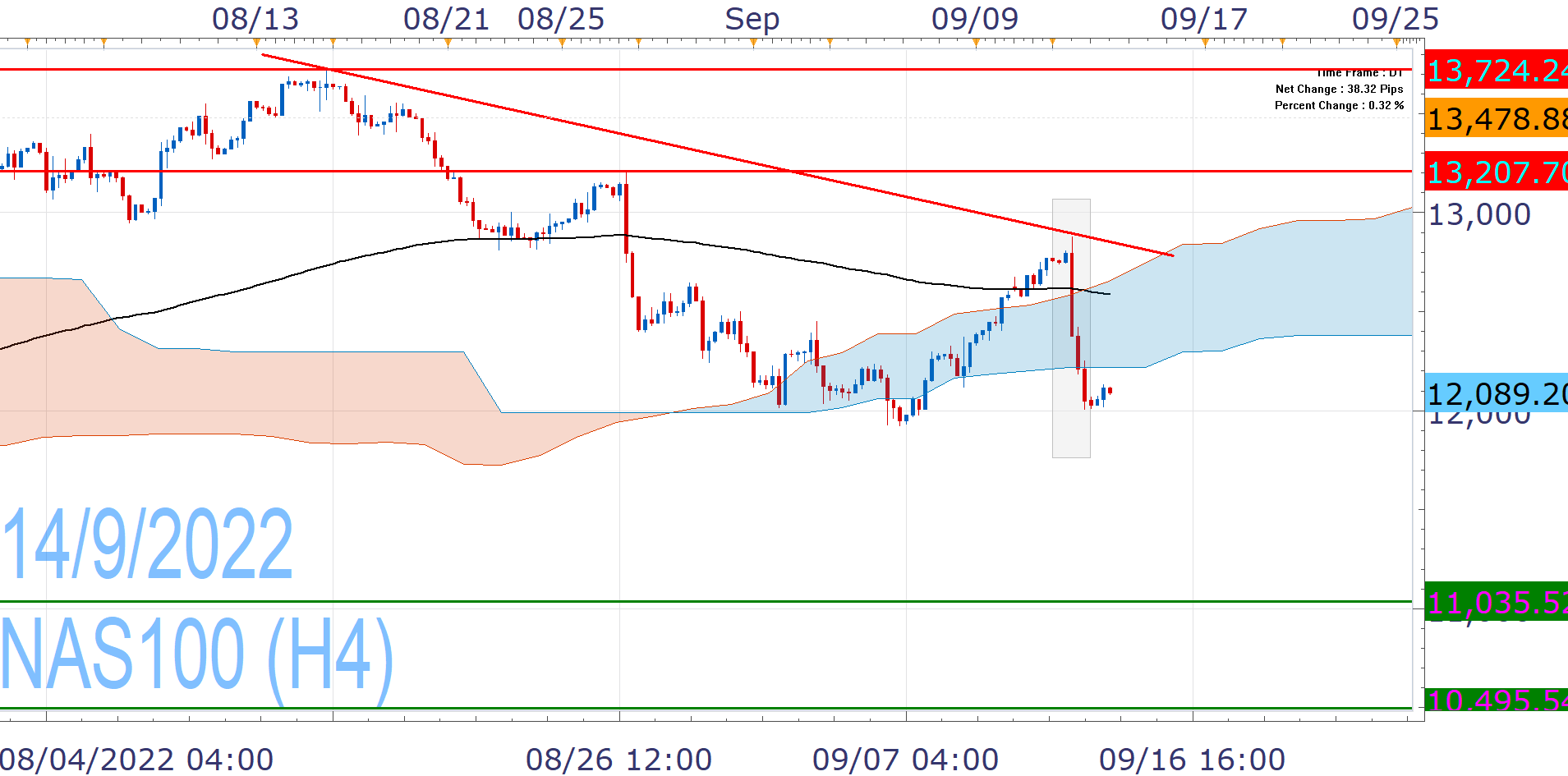

NAS100 closed the day below the daily Ichimoku Cloud, still trading firmly in bear territory, since it loses more than 20% from the November 2021 record high – which is generally seen as the threshold for such designation. However, it managed to defend the recent lows in the 12,000-11,915 region and finds reprieve today.

This may give it the chance for a rebound towards the EMA200 and the descending trendline from last month’s high (12,600-12,790), but a catalyst would likely be needed for such a move and we are cautious around the ascending prospects.

Bears are in control and we see risk of renewed pressure to 11,693, although it is probably be early for weakness below 11,035.

Nikos Tzabouras is a graduate of the Department of International & European Economic Studies at the Athens University of Economics and Business. He has a long time presence at FXCM, as he joined the company in 2011. He has served from multiple positions, but specializes in financial market analysis and commentary.

With his educational background in international relations, he emphasizes not only on Technical Analysis but also in Fundamental Analysis and Geopolitics – which have been having increasing impact on financial markets. He has longtime experience in market analysis and as a host of educational trading courses via online and in-person sessions and conferences.

1

Retrieved 16 Sep 2022 https://www.federalreserve.gov/monetarypolicy/fomcpresconf20220727.htm

Last Updated: ${lastUpdated}

Last Updated: ${lastUpdated}

Open an Account

Last Updated: ${lastUpdated}

The Dow Jones Industrial Average (DJIA) is one of the oldest and probably best-known stock indexes in the world. It is composed of 30 U.S.-based “blue chip” stocks, which change periodically based on market fluctuations and the fortunes of the individual companies. Four of the 10 largest U.S. companies ranked by market capitalisation were members of the DJIA as of 8 June 2022. However, all 10 are components of the S&P 500, which tracks the performance of 500 large-cap American stocks and is probably the most widely-followed stock index. These are the 10 largest publicly traded companies in the U.S.…

Familiarity with the wide variety of forex trading strategies may help traders adapt and improve their success rates in ever-changing market conditions.

A futures trading contract is an agreement between a buyer and seller to trade an underlying asset at an agreed upon price on a specified date.

Due diligence is important when looking into any asset class. However, doing one’s homework may be even more important when it comes to digital currency, as this asset class has been around for far less time than more traditional assets (like stocks and bonds) and comes with substantial uncertainty. Conducting the proper research on cryptocurrencies may require a would-be investor to explore many areas. One area in particular that could prove helpful is simply learning the basic crypto terminology. Certain lingo is highly unique to digital currency, making it unlikely that traders would have picked it up when studying other…

Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BTH) and Ripple (XRP) are leading cryptocurrency products. Each provides volatility and opportunity to traders. Learn more about them at FXCM.

Forex trading is challenging and can present adverse conditions, but it also offers traders access to a large, liquid market with opportunities for gains.

Determining the best forex platform is largely subjective. Trading Station, MetaTrader 4, NinjaTrader and ZuluTrader are four of the forex industry leaders in market connectivity.

Although similar in objective, trading and investing are unique disciplines. Duration, frequency and mechanics are key differences separating the approaches.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients’ best interests and represent their views without misleading, deceiving, or otherwise impairing the clients’ ability to make informed investment decisions. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.

Past Performance: Past Performance is not an indicator of future results.

Spreads Widget: When static spreads are displayed, the figures reflect a time-stamped snapshot as of when the market closes. Spreads are variable and are subject to delay. Single Share prices are subject to a 15 minute delay. The spread figures are for informational purposes only. FXCM is not liable for errors, omissions or delays, or for actions relying on this information.

Risk Warning: Our service includes products that are traded on margin and carry a risk of losses in excess of your deposited funds. The products may not be suitable for all investors. Please ensure that you fully understand the risks involved.

FXCM Markets Limited (“FXCM Markets”) is incorporated in Bermuda as an operating subsidiary within the FXCM group of companies (collectively, the “FXCM Group” or “FXCM”). FXCM Markets is not required to hold any financial services license or authorization in Bermuda to offer its products and services.

Risk Warning: Our products are traded on leverage which means they carry a high level of risk and you could lose more than your deposits. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent advice if necessary.

It is important that you read and consider the relevant legal documents associated with your account, including the Terms of Business issued by FXCM Markets before you start trading.

The provided information is not directed at residents of the United States, Canada, United Kingdom, European Union, Hong Kong, Australia or Japan and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

All services and products accessible through the site www.fxcm.com/markets are provided by FXCM Markets Limited with registered address Clarendon House, 2 Church Street, Hamilton, HM 11, Bermuda.

The FXCM Group is headquartered at 20 Gresham Street, 4th Floor, London EC2V 7JE, United Kingdom.

©2022 This website is owned and operated by FXCM. All rights reserved.

Exchange: ${getInstrumentData.exchange}

${getInstrumentData.bid} ${getInstrumentData.divCcy} ${getInstrumentData.priceChange} (${getInstrumentData.percentChange}%) ${getInstrumentData.priceChange} (${getInstrumentData.percentChange}%)