https://arab.news/59wyf

RIYADH: Dubai has issued a total of 24,662 new business licenses in the first quarter of 2022, reflecting 58% growth compared to the corresponding period a year earlier, WAM reported, citing a report from The Department of Economy and Tourism.

The figures are in line with the city’s goal to support productivity, growth, economic diversification, sustainability, competitiveness, developing strategic economic sectors, and providing high quality standards.

While 57 percent of the newly issued businesses were professional, 43 percent were commercial.

Bur Dubai district accounted for the largest share with 16, 577 licenses, followed by Deira, with 8,066 licenses, then by Hatta, with just 19 licenses.

In terms of legal structures, 33 percent of licensed were for sole establishment firms, 26 percent were civil companies, and 19 percent were limited liability companies.

Registration and licensing transactions amounted to 136,034 during the period, reflecting 36 percent growth, when compared to the corresponding period a year earlier.

Initial approvals reached 19,835, representing growth of 43 percent as opposed to the same period last year.

Additionally, trade name reservations hit 22,112, demonstrating growth of 29 percent, compared to the first quarter of 2021.

JEDDAH: Cadillac, a division of the US automobile manufacturer General Motors Corp., is planning to launch its first electric vehicle in Saudi Arabia during the first half of 2023.

The automobile major will launch Cadillac Lyriq in the US and China first, followed by the Middle East, according to Kristian Aquilina, managing director of Cadillac Middle East and international operations.

The company is presently finalizing the production and certification process of Lyriq with the local authorities, said Aquilina.

“We are talking to some government authorities, and their target of electrifying 30 percent of Riyadh’s transportation by 2030 is driving a lot of momentum,” Aquilina said.

According to a press note, Lyriq offers high-speed DC fast charging for public stations at 190 kW, enabling customers to add an estimated 76 miles of range in about 10 minutes of charging time.

For home charging, the luxury brand has a segment-leading 19.2 kW charging module, adding up to 52 miles of range per hour of charge.

• According to a press note, Lyriq offers high-speed DC fast charging for public stations at 190 kW, enabling customers to add an estimated 76 miles of range in about 10 minutes of charging time.

• For home charging, the luxury brand has a segment-leading 19.2 kW charging module, adding up to 52 miles of range per hour of charge.

• The manufacturer confirmed that six luxury electric vehicles will be present by 2025, outlining its commitment to the Kingdom’s clean mobility.

The manufacturer confirmed that six luxury electric vehicles will be present by 2025, outlining its commitment to the Kingdom’s clean mobility and net zero 2060 targets.

The Cadillac Lyriq will be the first in the line, followed by the newly revealed Celestiq, which will offer Ultra Cruise, its hands-free driver assistance technology running on Qualcomm’s Snapdragon ride platform. The machine will also feature a smart glass roof manufactured by US-based nanotechnology company Research Frontiers with a dashboard-width touch screen.

Like the Cadillac Lyriq, Celestiq will use GM’s Ultium battery technology and Battery Electric Vehicle 3 platform.

Cadillac’s Global Vice President Rory Harvey told Arab News that the automobile manufacturer would transform into an all-electric brand by the decade’s close.

“I’m on public record saying we will be all EV by 2030,” he said.

Super Cruise, the region’s first hands-free driving assistance technology, will also be available in 2024 on Cadillac’s entire fleet.

Commenting on the competition from EV manufacturers, Harvey said Cadillac has a competitive advantage due to its experience producing cars in large numbers with the right quality.

He further said that having a dealership base also allows the American automobile to provide after-sales service to its consumers.

“There’s just a huge amount of advantages out there for us as historical original equipment manufacturers,” he added.

Aquilina pointed out that the Celestiq is going to have a low volume production because of its select premium target audience.

The Kingdom is currently in the early stages of developing infrastructure here, and it will move very quickly, he added.

Together with GM, Cadillac will collaborate closely with Saudi Arabia’s entire ecosystem to ensure infrastructure readiness and consumer acceptance.

DUBAI: UAE-based private equity fund Al Zarooni Emirates Investments will establish a venture studio at Dubai-based Citizens School where students can develop new startups and receive funding, according to the group’s chief investment officer.

Hisham Hodroge, CEO of Citizens School and chief investment officer of Al Zarooni Emirates Investments, told Arab News that the venture studio would create new startups from ideation to market.

“If the child creates an idea and wants to continue, the venture studio will work with the child and develop the idea further by funding it,” Hodroge said.

“There’s a fund allocated to these ideas and the students graduate, hopefully as business owners,” he added.

Through an initiative such as this, students can learn the ropes of business early, develop business ideas and embrace entrepreneurship by the time they graduate.

Al Zarooni Emirates Investments is currently the sole investor and promoter of the educational institution.

The 43,000 sq. m. school campus has a capacity of 2,600 children and fees range from 36,000 dirhams for stage one of the UK-based Early Years Foundation framework to 52,000 dirhams in the sixth year.

According to a statement, Citizen School uses a custom-built curriculum called Citizens Tapestry, in which students are taught entrepreneurship courses in grade one, according to Hodroge.

Situated in the plush Al-Satwa locality, the school aims not only to create entrepreneurs but to provide its students with the skills to become entrepreneurs. “Our ultimate aim is to instill entrepreneurship skill sets,” Hodroge added.

The school has been progressive on the administrative front as well. Come September, and the school will let parents pay the tuition fees in Bitcoin and Ethereum.

“The reason we are accepting crypto payments is to start a conversation among parents and children about the technology that will influence the lives of the young generations,” said Hodroge.

He added that nearly 10 percent of the parents who have enrolled their children opted to pay in cryptocurrency.

“A while ago, cryptocurrency was only a floating term among well-versed investors. However, today cryptocurrency is becoming much more mainstream, reshaping the traditional financial system,” said Adil Al Zarooni, founder of Citizens School, in a statement.

The shift in approach was primarily driven by its participation in the UAE Future of Learning 2022 survey, which found that 69 percent of parents in the UAE believe artificial intelligence and virtual reality will significantly impact their children’s future.

The survey further pointed out that 54 percent of those parents cited cryptocurrency and the metaverse as the next big influencers.

“Our research shows that there’s a need for education to adapt and evolve by better equipping children with the skills they will need to thrive in an uncertain future,” Al Zarooni said in a statement.

RIYADH: Saudi Arabia is leading the way with sustainable, energy-efficient desalination projects while maintaining its position as a world leader in desalinated water production.

The Middle East and North African region have some of the lowest water availability levels per capita among the world’s most water-scarce regions.

This makes the region heavily dependent on desalination, even though desalination directly impacts the issue of sustainability and renewable energy.

Developers in the Kingdom, however, aim to maintain their plants and operations in line with the country’s Vision 2030 goals and its leadership position in desalinated water production.

Saudi energy firm ACWA Power is moving away from thermal-powered systems and switching entirely to reverse osmosis plants to facilitate efficient power consumption, said Tariq Nada, the company’s vice president for water and technical services.

ACWA Power is the world’s largest private operator of water desalination plants, with a production capacity of 6.4 million cubic meters of desalinated water a day.

The company has a robust portfolio of 10 seawater reverse osmosis projects in the Kingdom and the Gulf Cooperation Council, in which some projects are partially powered by renewable energy.

The desalination industry has also strengthened with the advent of international companies in the Kingdom. Spain’s Acciona, a leader in renewable energy and infrastructure, is one example. The company has delivered two plants in the Kingdom.

It is currently building four more, producing more than 2.36 billion liters of drinking water daily, providing water for more than 8 million people in the country, which is about a quarter of the population.

Julio de la Rosa, Acciona’s business development director for water solutions in the Middle East, told Arab News that the company reduced the emissions associated with desalination by integrating solar energy at the plants and optimizing brine reuse.

Acciona reduced the emissions associated with desalination by integrating solar energy at the plants and optimizing brine reuse.

Julio de la Rosa, Acciona’s business development director for water solutions in the Middle East

The execution of these projects is in alignment with the UN Sustainable Development Goals and the company’s vision of designing a better planet, Rosa said.

Each project designed and implemented by Acciona promotes sustainable development from all three perspectives: Environmental, economic and social.

Rosa said their technology enables them to deliver on their promise and mission to build sustainable water treatment in the Kingdom.

In the last few years, Acciona has developed several projects such as Tabuk 2, Buraydah 2, Madinah 3, independent water project Shuqaiq 3, SWRO Alkhobar phases 1 and 2 and Jubail 3B.

The Jubail 3B desalination plant will filter 570,000 cubic meters per day, enough to supply 2 million people in Riyadh and Qassim once it begins operation in 2024.

The plant will draw some of its power from a dedicated 61 megawatts photovoltaic facility, which Acciona will also build.

This facility will be the largest in-house solar plant for a desalination plant in the Kingdom. It will reduce the emissions associated with desalination and relieve power demand from the national grid.

In addition, the project includes storage tanks, an electricity substation, an overhead transmission line spanning 59km and associated marine works.

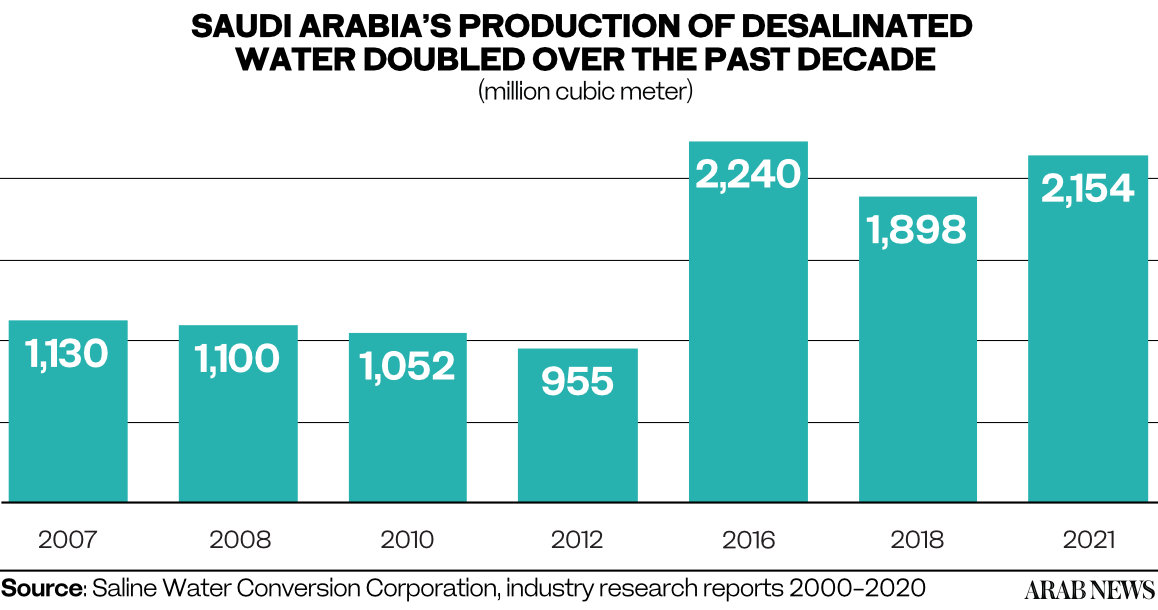

RIYADH: Water desalination in Saudi Arabia has doubled over the past decade to reach 2.2 billion cubic meters in 2021, up from 1.1 billion cubic meters per year in 2010, thanks to a major overhaul of some existing plants and the introduction of new technologies.

For instance, Jubail 2, one of the Kingdom’s largest water desalination plants that serve Riyadh and Jubail, increased its annual production capacity by roughly 30 percent to 380 million cubic meters in 2021 from under 300 million cubic meters in 2014.

However, to meet the growing domestic demand for water, the desalination industry in the Kingdom is all poised to consider making another breakthrough.

A brief history outlined below shows water desalination plays a vital role in the Kingdom’s economy.

The process of water desalination in the Kingdom dates back to the early 1900s, when Jeddah became the first city to install two privately-owned distillation condensers to meet the city’s rising demand.

Yanbu and Jazan, the other coastal cities of the Kingdom, followed the same approach of developing their private seawater distillation condensers until the entire industry was nationalized and regulated under the Ministry of Environment, Water and Agriculture in 1965.

As the method started gaining popularity in the region, the Saline Water Conversion Corp. was founded as an independent government entity in 1974 to promote and regulate water distillation operations in the Kingdom.

Although it started as costly and inefficient, it was crucial for the Kingdom’s increasing population needs.

Further, its geographic location puts it at a disadvantage in accessing different types of water resources like, for example, rainfall.

Therefore, its options were limited to shallow and deep groundwater and desalinated water.

The rise in population to 33.5 million in 2018 from just 25.2 million in 2007 brought about a 70 percent increase in potable water demand, according to a research report published in the Journal of Water Process Engineering back in 2019.

The report added that it would be impossible for groundwater to last 50 years at this consumption rate, highlighting the option of water desalination, which has been strategically considered and implemented by the government.

In 2010, SWCC produced some 1.1 billion cubic meters of water at its 30 desalination plants located on the east and west coasts of the Kingdom, which met approximately 50 percent of the domestic water demand in the Kingdom.

The company further improved its capacity to 5.2 million cubic meters per day of water or 1.9 billion cubic meters a year, in 2018.

In 2021, SWCC produced 2.2 billion cubic meters of water and operated 32 production plants. As a byproduct of water distillation, it generated 47 million megawatts per hour of electricity.

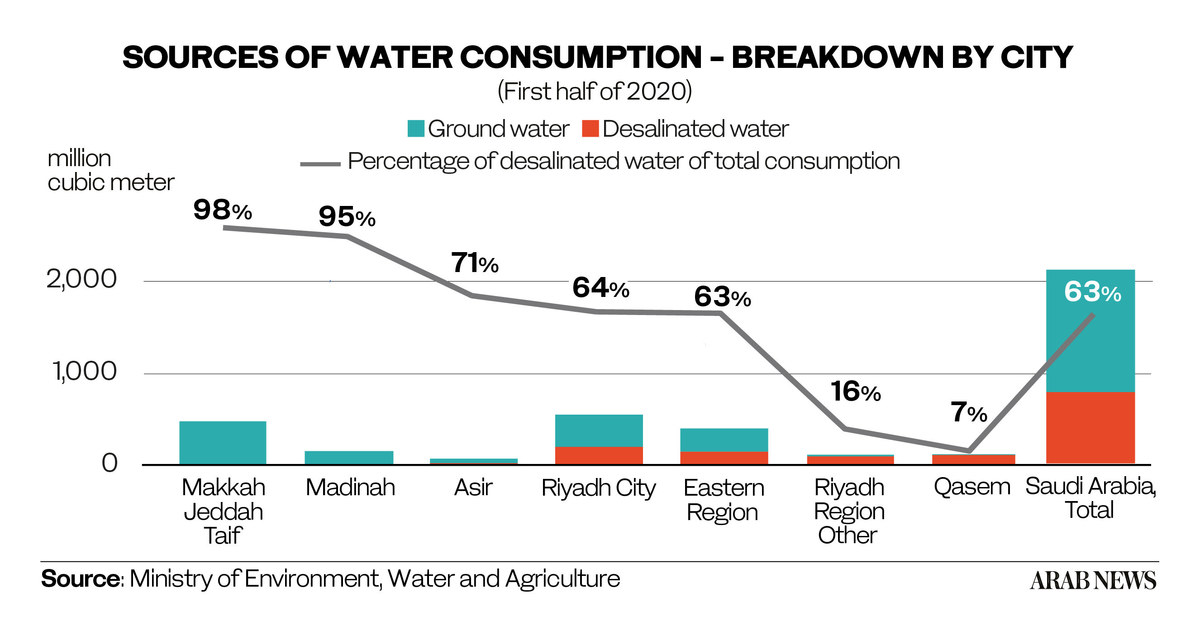

In major cities, the desalinated share in total water consumption is pretty high, especially in the cities like Makkah, Jeddah and Taif where almost all of their drinking water comes from nearby desalination plants.

The share for Riyadh and the Kingdom stood at 63-64 percent in 2020.

Thermal distillation and reverse osmosis are the two most popular methods used to convert seawater into potable water.

The former uses heat to vaporize seawater, separating the salt from the water, and then the vaporized gas is cooled down into the water through condensation.

The latter passes seawater through a semipermeable membrane that separates salt from water, wasting less energy in the process.

Moreover, SWCC has partaken in two renewable energy projects being developed in alignment with the Vision 2030 blueprint.

The future of water desalination in Saudi Arabia looks promising and challenging simultaneously. Therefore, SWCC aims to take on more renewable sources for its water desalination projects, to reduce the conversion cost, thereby improving conversion efficiency and cutting carbon emissions simultaneously.

Assuming the current population growth rates hold through the next 10-15 years, the Kingdom may require a desalinated water capacity of up to 4.5 billion cubic meters per year in 2040, a profound research report released in 2014 suggested. In effect, the output will be required to double again from the 2021 production level.

No matter how efficient or productive methods of water desalination get, at this rate, Saudi Arabia will have to resort to methods of decreasing demand, whether it is through awareness campaigns or imposing taxes on high water usage.

CAIRO: Tabby, the UAE-based buy now, pay later fintech company, will soon be widening its scope in Saudi Arabia with the introduction of its virtual card in the Kingdom.

The Tabby virtual card is a Visa card that allows shoppers to split their purchases into four payments at select in-store locations.

Fresh off securing $150 million in debt financing in early August, the company wants to provide easy payment options in the Arab world’s largest economy, where less than 20 percent of the population has a credit card, said a senior company official.

“Saudi Arabia has a penetration rate of around 0.3 credit cards per person, so there is a real need for easy consumer credit, especially for day-to-day payments,” Abdulaziz Saja, general manager of Tabby Saudi Arabia, told Arab News exclusively.

Tabby is aiming to empower in-store users using the virtual card in addition to a huge focus of the company’s operations going into providing payment solutions for all users, not just online.

Abdulaziz Saja, general manager of Tabby Saudi Arabia

Users can activate the card using the Tabby app, add it to their preferred digital wallets and tap the payment terminal at checkout to divide their payments into installments.

“After the successful launch of the Tabby Virtual Card in UAE, we want to bring it to Saudi Arabia,” said Saja.

He added that Tabby is aiming to empower in-store users using the virtual card in addition to a huge focus of the company’s operations going into providing payment solutions for all users, not just online.

The company will also use its recently raised funding to sustain its balance sheet as BNPL requires very high capital.

“Some of that funding will also invest in young Saudi talent. Because as we grow the company, we’ll also be looking into hiring locally for product managers and software engineers,” Saja added.

Tabby currently operates in the UAE, Saudi Arabia, Kuwait and Egypt, with 85 percent of its sales volume happening in the Kingdom, Saja stated.

He attributed the company’s growth in the Kingdom primarily to the rise in the adoption of e-commerce during the COVID-19 pandemic.

“An additional factor is the effect of a 15 percent value-added tax that has also put a bit of stress on customer disposable incomes here,” he added.

Saja also said that the Saudi market has a huge population compared to the UAE, in addition to the booming last-mile delivery services in the Kingdom.

The Saudi Central Bank’s Sandbox program also nurtured the company, closely monitoring its challenges and performance.

“We’ve also given back to the community by mentoring young companies participating in the Saudi fintech accelerated program,” Saja said.

“Our main stakeholder in Saudi Arabia is the central bank, but we’ve also engaged with several other entities that have helped us either source talent or connect with investors,” he added.

Tabby has raised $275 million since its launch in the UAE in late 2019. Its latest $150 million round was from US-based venture capital firms Atalaya Capital Management and Partners for Growth.

Tabby currently has over 4,000 global brands and small businesses, with over 2 million active users on its platform.

The company also experienced 10 times growth in revenue, eight times in active users, and three times in active retailer partners in just the first half of 2022 compared to the same period last year.